The Short Answer

The Loan To Value (LTV) ratio is used to determine whether a lender should approve a loan within the mortgage lending field. The loan to value ratio indicates the amount of debt that is going to be needed, in relation to the value of the property. In the case of 80% LTV mortgages, 80% of the property’s value will lie in the mortgage, and the other 20% will be equity in the form of a down payment.

Typically, an 80% Loan To Value mortgage will require a 20% down payment, a credit score of around 740, verifiable employment and income, as well as a home appraisal that indicates that the home is in the condition required for the mortgage. The Loan To Value figure can often dictate the mortgage term and interest rate.

Skip To

What Is An 80% LTV Mortgage?

The Loan-To-Value (LTV) ratio is a direct measurement between the mortgage or debt, and the value of the property being purchased. The Loan To Value ratio is an important number for lenders who use it to determine whether they should approve a loan, and what terms they are going to offer a borrower. The LTV ratio is the inverse of the down payment, for example if a down payment is 25%, the LTV will be 75% for a property.

As such, a “good” Loan To Value ratio is determined by the type of loan application. For the average home mortgage, an 80% LTV is considered relatively good. This would require a down payment of 20% of the purchase price, along with the closing costs. Anything above 80% would require private mortgage insurance, which is an extra cost. To qualify for better mortgage term options however, a loan to value number that is lower than 80% would be necessary.

An 80% LTV mortgage is one where the mortgage is worth 80% of the property’s value. The remaining 20% comes from the down payment that the borrower has made, which is counted as equity in the home. To figure out what the LTV would be, you can use the following formula:

LTV = Mortgage amount / Property value

80% LTV Mortgages Requirements

An 80% Loan To Value ratio is considered standard for lenders as this doesn’t pose a large amount of risk for them. Anything higher than this poses a higher risk and therefore comes with less desirable mortgage loan term options and mortgage rates.

80% LTV mortgages are typically provided by conventional lenders who have certain criteria that borrowers need to meet, in order to qualify for these loans.

- The main requirement for an 80% LTV mortgage is a Loan To Value ratio of no higher than 80%.

- The next requirement is a credit score of around 740.

- A 20% down payment will need to be made to achieve the required 80% LTV ratio so this is a requirement as well.

- A borrower needs to have at least 2 years of stable employment and an income that they can verify for the same time period.

- The condition and value of the home needs to meet the minimum standards for the mortgage lender. This is determined by a home appraisal.

Bear in mind however, due to the fact that the mortgage loan is based on the LTV ratio, some lenders may be flexible on the other requirements. However, a 20% down payment shows a lender that a borrower has the assets to cover a large amount of the purchase price and is therefore less likely to default on their mortgage payments.

For investment property purchases and multi-family property deals, the Loan To Value requirements will be lower. These may require a higher deposit of say 25%, with an LTV ratio of 75%. Typically, however, the higher LTV ratio options are better for mortgage deals.

80% LTV Mortgage Table

To highlight how an 80% LTV mortgage works in a real-world example, we’ve put together a scenario based on the mortgage loan for a property valued at $200,000.

LTV Mortgage Table

| 20% down payment | |

|---|---|

| Appraised property value: | $200,000 |

| Down payment: | $40,000 |

| Mortgage amount: | $160,000 |

| LTV calculation: | $160,000/$200,000 = 0.8 |

| LTV ratio: | 80% |

Best 80% LTV Mortgages For Residential Properties

Rocket Mortgage (Quicken Loans)

Rocket Mortgage offer 80% LTV loans on both their 15-year fixed mortgage rates and adjustable mortgage rates loans where the loan to value cannot exceed 80%. The 15-year fixed loan is a longer mortgage term with a fixed mortgage rate that is best for a buy and hold scenario.

Once the period of fixed mortgage rate ends, the lender’s standard variable rate will generally apply. A minimum FICO score of 620 is required for the fixed mortgage rates loans. The adjustable rate loans have similar requirements, but with an adjustable mortgage rate instead and the lender’s standard variable rate may apply.

CMG Financial

CMG Financial offers a variety of loans, one of which is a conventional home loan which requires a 20% down payment and is therefore an 80% LTV mortgage. The lender also offers lower down payment options for those who cannot put 20% down. The minimum credit score required for these loans is 620, and various property types can be financed using this loan, including primary residence, rental properties and investment properties.

Chase Bank

To qualify for a home loan with Chase Bank, there are a few basic requirements. These include proof of the borrower’s ability to repay the loan, an 80% Loan To Value ratio, a 20% down payment, a Debt-To-Income (DTI) ratio of 43% or less, and the minimum FICO score required for these mortgage deals. Chase offers a variety of loan products to suit various mortgage lending needs and loan to value amounts.

Best 80% LTV Mortgages For Investment Properties

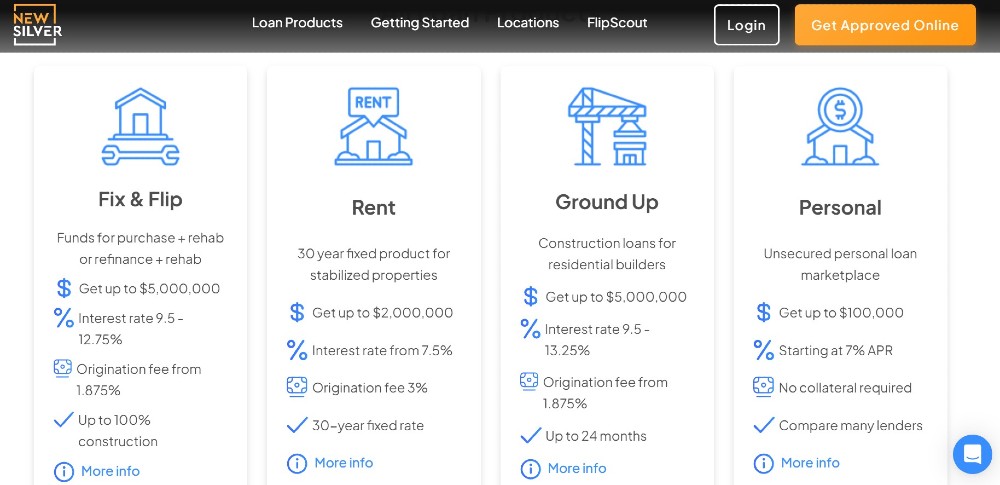

New Silver

New Silver’s rent loan is aimed at investors who are purchasing a property to buy and hold, and rent out to generate a passive income. These investors are typically in need of longer term loans with lower interest rates, and an LTV that’s workable. New Silver offers loans for LTV’s of up to 80%, at interest rates of 7.5% and up, for 30 years at a fixed rate.

To qualify for these loans, borrowers need a minimum FICO score of 680, and it should be a residential 1-4 unit property. The minimum amount that can be borrowed is $100,000 and the maximum is $2 million on these loans.

Kiavi

Kiavi is a lender that provides capital to real estate investors. The lender provides bridge loans (fix and flip) and rental loans. The bridge loan interest rates start at 6.95%, and borrowers can get a mortgage amount from $100,000 to $1.5 million.

Kiavi has flexible mortgage terms on their long-term rental financing which is 30 years. The interest rates on these mortgage deals begin at 6.875%. There are two loan options, either a 5/1 ARM or a 7/1 ARM, and both are fully amortized.

LendingOne

LendingOne provides mortgage deals for rental properties, fix and flips, new construction, multi-family properties and portfolio rentals (which are multiple rentals at one time). Using their own capital, LendingOne provides loans solely to real estate investors, with up to 90% of the purchase and repairs covered for fix and flip loans.

Advantages of 80% LTV Mortgages

The benefits of 80% LTV mortgages are significant when it comes to qualifying for a loan to purchase a property.

- An 80% LTV mortgage provides borrowers with better mortgage loan terms and rates. An 80% LTV ratio means that 20% of the purchase price has been taken care of in the form of a down payment. This means that the borrower is less likely to default on their monthly mortgage payments, as such, are less of a risk to lenders. So, lenders can provide better loan options to borrowers who have an LTV of 80% or lower.

- Those who use an 80% LTV mortgage can avoid having to take out private mortgage insurance (PMI) which saves money on mortgage payments, and extra hassles. LTV’s that are higher than 80% typically require PMI, as these borrowers are at a higher risk of defaulting on their loan.

- Qualifying for an 80% LTV mortgage loan means that borrowers need to make sure that they can put down 20% of the purchase price as the down payment. This is good motivation to contribute as much as they can towards the down payment, and therefore build equity in the property from the outset. They can build on this as they go, however, 20% equity in a property is a good place to start.

- An 80% LTV mortgage can provide investors with more leverage, which can increase their potential returns. For example, if an investor purchases a property for $500,000 with a $100,000 down payment and the property appreciates by $100,000, the investor’s return on investment (ROI) would be 100%. However, if the investor purchased the same property with a $20,000 down payment (80% LTV mortgage), the ROI would be 500%.

Disadvantages of 80% LTV Mortgages

While 80% can be a great option for homebuyers and real estate investors, there are some drawbacks to these loans as well.

- An 80% LTV mortgage typically comes with a higher mortgage rate than a traditional mortgage. This can mean higher monthly payments, which can eat into an investor’s profits.

- Mortgage loans that are as little as 5% lower, ie; 75% LTV, are offered significantly better rates than 80% loans. Which means that, for a down payment that is just 5% larger, borrowers can save a lot on their overall mortgage payments and qualify for a better interest rate in some cases.

- A 20% deposit is a necessary requirement for an 80% LTV mortgage, and this can be a large amount for big properties, or properties in expensive areas. This means that it could take borrowers a longer time to gather the funds for the down payment.

- If the property value decreases, the investor may owe more on the mortgage than the property is worth, which is known as being “upside down” on your mortgage.

80% LTV Mortgage Alternatives

Crowdfunding

For real estate investors who are looking for an alternative solution, crowdfunding has become a popular option. It allows investors to find the funding for their real estate deal, without having to use a specific lender. Instead, the investor needs to display the deal on a crowdfunding website where other investors pool their funds and can choose to fund the deal.

This method doesn’t require a specific LTV, in fact there are no hard and fast criteria for qualifying for a crowdfunding loan, only the quality of the deal. Which means that investors who don’t have a 20% down payment, or who can’t qualify for an 80% LTV mortgage, can still get financing by crowdfunding. The interest rate offered on each loan will vary.

80-10-10 Loans

An 80-10-10 loan is a great option for buyers who need a little extra help saving for their first home. Rather than having one large mortgage, this type of loan is split into two – a primary loan and a second loan. The primary mortgage will typically cover 80% of the purchase price while the second lien covers the remaining 10%. Which means that buyers only have to come up with the remaining 10% as a down payment.

This split can help people save money on the interest rate associated with traditional mortgages by not having to borrow the full 90%. Not only that, but it also offers more flexibility when it comes to qualifying for a loan since people are borrowing less money overall as the interest rate impacts this.

USDA Loans

USDA loans are government-back loans that are issued by the US Department of Agriculture. These are aimed at assisting citizens in rural areas who would like to purchase a home but cannot afford it. Home buyers can generally finance up to 100% of the purchase price of an existing home with USDA loans, and any “excess expenses” will typically be covered as well. These include the appraisal fee, tax service fee, homeownership education and the initial contribution to escrow.

VA Loans

VA loans are offered to current US military members and veterans. These loans allow borrowers to finance up to 100% of the home’s purchase price, with no need for a higher LTV ratio or any major focus on Loan To Value. However, borrowers will still need to cover the home loan closing costs and other fees associated with the purchase.