Best Hard Money Lending Software

Does Hard Money Lending Software Exist?

Yes! Hard money lending software is a powerful tool that automates and simplifies the loan origination process for private lending. This type of Loan Origination Software (LOS) supports the entire loan lifecycle, from application to servicing. By reducing manual tasks and centralizing operations, this software saves time, minimizes errors, and accelerates the lending process. It enables lenders to focus on building relationships and scaling their businesses while improving efficiency.

Who Uses Hard Money Lending Software?

There are various use-cases for hard money lending software:

Correspondent Lenders: Use hard money lending software to originate and fund loans efficiently on behalf of their own brand. The software streamlines loan packaging, compliance tracking, and integration with buyers’ systems.

Brokers: Use loan origination software to manage client relationships, loan applications, and negotiations. CRM features in hard money lending software make it easier to handle multiple clients and deals simultaneously.

Real Estate Investors: Use hard money loan software to apply for loans, track their loan status, and communicate with lenders.

Loan Originators: Use loan origination software to automate underwriting, document collection, and borrower evaluations. This allows them to process applications faster, ensure compliance, and manage more loans efficiently.

Real Estate Developers: Use hard money lending software to secure financing for construction or redevelopment projects quickly. This software speeds up the loan approval and disbursement process, allowing them to keep projects on schedule.

Best Hard Money Lending Software In 2025

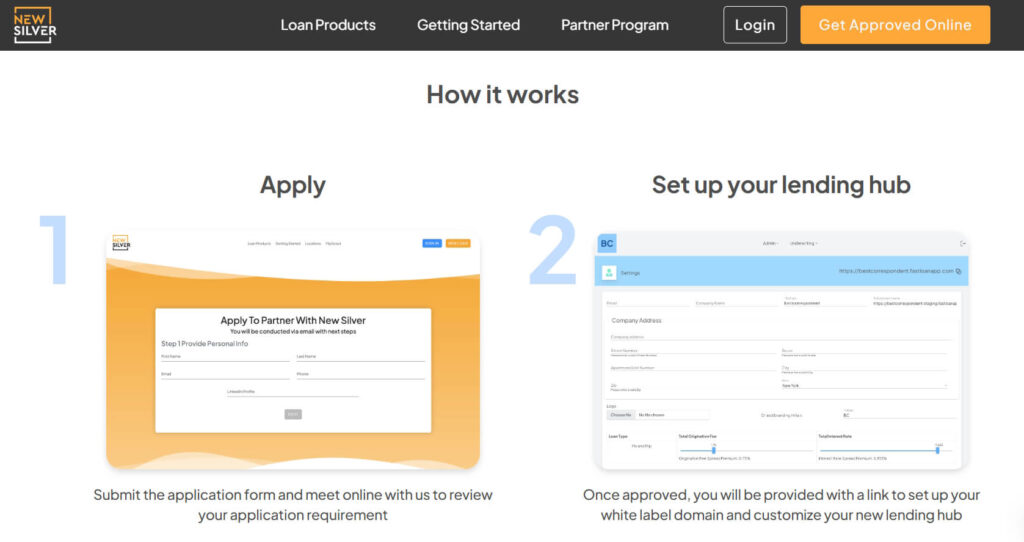

Software Option 1: New Silver

New Silver sets a new standard for loan origination software by delivering an advanced hard money lending platform tailored specifically for real estate investors and private lending. Unlike other platforms, New Silver combines innovation, speed, and a real estate-centric approach to deliver unmatched efficiency and performance for the loan origination process.

New Silver’s loan origination platform is designed exclusively for real estate investing, particularly fix and flip, and ground up construction loans. Using cutting-edge technology, it provides instant online approvals, term sheets and proof of funds, giving borrowers a competitive edge in fast-moving markets. New Silver’s platform has a robust infrastructure that supports growing portfolios without sacrificing speed or reliability.

New Silver’s intuitive interface, combined with its specialized features, makes it the easy choice for private lenders or hard money lenders looking to scale operations, optimize processes, and achieve better outcomes quickly. By choosing New Silver, private lenders gain access to a platform that goes beyond basic loan servicing software, offering a smarter, more efficient way to manage hard money lending.

Complimentary White Label Loan Origination System (LOS): Partners receive free access to a customizable LOS platform, enabling them to brand and tailor the system to their specific needs.

Instant Online Approval and Term Sheets: The software provides borrowers with immediate online approvals and term sheets, enhancing the efficiency of the lending process.

Comprehensive Borrower Management Dashboard: Partners can manage all borrowers and loans through a dedicated dashboard, facilitating document uploads, draw request management, appraisal orders, and loan status monitoring.

Access to Reliable Capital: The program offers partners dependable capital sources, supporting their lending operations and growth.

Revenue Sharing Opportunities: Partners can earn origination fees and yield spreads throughout the life of the loan, providing ongoing income streams.

Client Relationship Retention: The program allows partners to maintain direct relationships with their clients, ensuring continuity and personalized service.

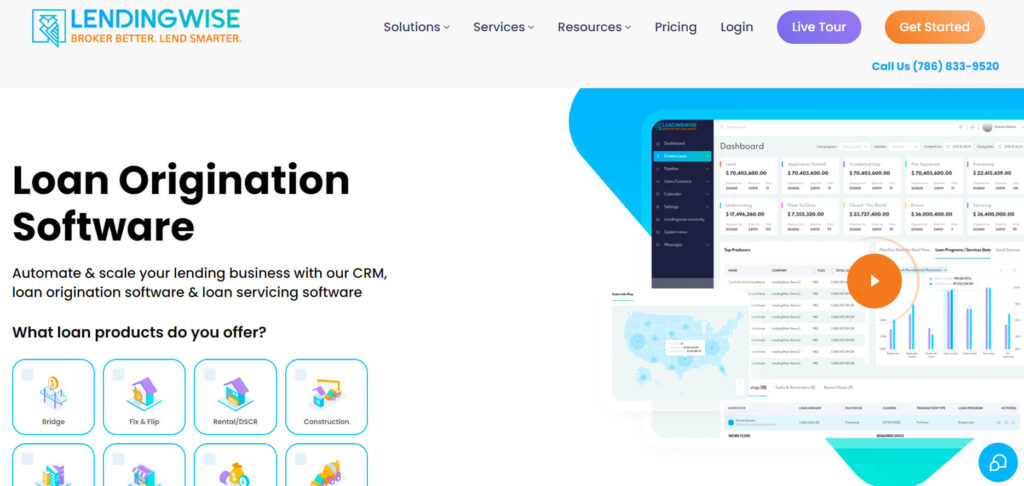

Software Option 2: Lendingwise

LendingWise is a cloud-based loan origination software and loan servicing software that also integrates CRM tools, making it an all-in-one platform for hard money lenders. The platform supports various loan types, including rentals, bridge loans, fix-and-flip projects, multifamily loans, CRE loans, and SBA loans. LendingWise offers features like draw management, asset management, and customizable loan application setups.

Designed for individual lenders, organizations, and brokers, LendingWise offers a versatile solution to handle everything from loan setup to servicing. Its integration of loan origination, servicing, and CRM tools allows lenders and brokers to oversee the entire loan lifecycle seamlessly.

Software Option 3: The Mortgage Office

The Mortgage Office is a comprehensive loan origination software and loan servicing software built to meet the needs of both private lending and hard money lenders. Designed for the real estate financing industry, this platform simplifies the loan lifecycle, from borrower management to servicing and beyond.

What sets The Mortgage Office apart is its flexibility and integration capabilities. It supports various loan types and structures within the hard money lending space and integrates seamlessly with accounting systems. The software automates payment processing, enhances borrower communication, and provides tools for risk management and compliance tracking. Additional features include reporting and analytics, enabling more informed decisions and transparency for private lending.

Software Option 4: Liquid Logics

Liquid Logics offers loan origination software tailored for the private money and residential lending industries. This cloud-based platform supports the entire loan lifecycle and stands out for its customizability and accessibility.

The software can be fully branded to match a client’s website, including logos, colors, and design, providing a seamless borrower experience. As a mobile-responsive and fully online solution, Liquid Logics allows users to access the platform from anywhere. Key features include one-click access to integration services such as appraisals, title services, and credit checks, making it a comprehensive tool for brokers, loan originators, and investors.

Must Have Hard Money Lending Software Features

- Streamlines Applications: Borrowers can apply online with features like automated data validation and document uploads.

- Pre-Qualifies Borrowers: Automated tools assess eligibility instantly, filtering out ineligible applications early.

- Automates Underwriting: Advanced algorithms analyze financial details for consistent, data-driven decisions.

- Manages Approvals: Systematic workflows ensure smooth and timely loan approvals.

- Simplifies Document Handling: Easily generate, store, and manage loan agreements and other paperwork.

- Supports E-Signatures: Borrowers and hard money lenders can finalize agreements digitally for added convenience.

- Facilitates Closings: Automated tools streamline loan agreement formalization and funds disbursement.

- Ensures Compliance: Built-in tools maintain regulatory standards and generate compliance reports.

- Handles Loan Servicing: Automates payment collection, interest calculations, and escrow management.

- Provides Analytics: Offers valuable insights into loan performance and key metrics for data-driven decisions.

Final Tips For Choosing The Right Hard Money Lending Software

Tip 1: Prioritize Accessibility

Choose loan origination software that is easily accessible across various platforms, such as smartphones, tablets, and laptops. This ensures that all users, regardless of their device, can quickly and efficiently access the information they need, enhancing productivity and collaboration.

Tip 2: Align with Your Goals

The loan origination software should align with your specific business goals. Start by identifying what you need from the hard money lending platform. For instance, if your focus is on managing fix-and-flip loans, opt for a solution tailored to this purpose. Similarly, if speed is a top priority, prioritize software that emphasizes fast loan approvals and processing.

Tip 3: Evaluate Integration Capabilities

Ensure the software integrates seamlessly with other systems you rely on, such as accounting software, payment processors, or credit-check services. Strong integration capabilities can streamline your workflows and significantly boost efficiency by reducing the need for manual data entry.

Tip 4: Opt for User-Friendliness

A user-friendly interface is critical for smooth adoption by your team. Look for hard money loan software with intuitive navigation and minimal learning curves to reduce training time and improve overall productivity. The easier the system is to use, the faster your team can fully leverage its features for a streamlined loan origination process.

Tip 5: Assess Customer Support

Reliable customer support is essential for any loan origination software solution. Issues or questions will inevitably arise, so having access to responsive and knowledgeable support can save valuable time and minimize disruptions. Check for 24/7 support options or dedicated account managers for added reliability.