Quick Summary

The 50 Percent Rule is a shortcut that real estate investors can use to quickly predict the total operating expenses that a rental property investment is likely to generate. To work out a property’s monthly operating expenses using the 50 rule, you simply multiply the property ‘s gross rent income by 50%.

Table of Contents

50 Percent Rule Real Estate Calculator

50 Percent Rule Formula For Real Estate

Total Operating Expenses of Rental Property = Gross Monthly Income * 50%

As you can see from the formula above, it’s pretty easy for an investment property owner to use the 50 percent rule. You are literally just multiplying the monthly rent by 0.5 to estimate the property ‘s operating expenses. To do the calculation in your head, you can just divide the rental income by 2 (mathematically this is exactly the same as multiplying the rent by 0.5).

What Expenses Are Included In The 50 Percent Rule

- Property Insurance

- Property Tax

- Maintenance/Repairs

- Utilities

- Property Management

- Home Owner Association (HOA) Fees

It is evident from the list above that the 50 Percent Rule lumps all the recurring operating expenses together, excluding loan repayments. It’s a shortcut for calculating the total operating expenses.

Side note – There are some people who suggest that HOA fees aren’t factored into the rule. However, like property insurance and property taxes, HOA fees are an ongoing monthly expense. As such, they should be treated as an operating expense, and that is exactly what the 50 percent rule is designed to calculate.

What Expenses Are Excluded From the 50% Rule

- Mortgage Payment

- Tax on Rental Income

- Property Depreciation

Are mortgage repayments factored into the 50 Percent Rule?

In short, no. The 50 percent rule covers all monthly operating expenses, but your monthly mortgage payment is excluded from the equation.

50 Percent Rule Example

- Monthly Rent: $3,000.00

- Total Operating Expenses = Monthly Rent * 0.5

- Total Operating Expenses = $3,000 * 0.5

- Total Operating Expenses = $1500

Does the 50 percent rule apply to multifamily real estate?

Yes. The reasoning is simple. A multifamily apartment complex is effectively just a collection of single-family apartments. If the 50% rule can be applied to one of the apartments, it can be applied to all of the apartments in the multifamily property.

Can you use the 50 percent rule to workout rental property cash flow?

You can use the 50% rule to work out the cash flow of a rental property real estate investment. The process is outlined below.

Cash Flow Example Using 50 Percent Rule

Cash Flow = Rental Income – Total Operating Expenses – Mortgage Repayment

Property Details

- Monthly Rental Income: $3,200

- Monthly Operating Expenses: $3200 * 0.5

- Monthly Mortgage Repayment: $1342

Plugged Into Cash Flow Formula

- Cash Flow = 3200 – $1600 – $1342

- Cash Flow = $258

Rental Income: The 50 percent rule assumes that you already know the rental income of the property.

Total Operating Expenses: You apply the 50 percent rule to the rental income to quickly calculate the predicted operating costs.

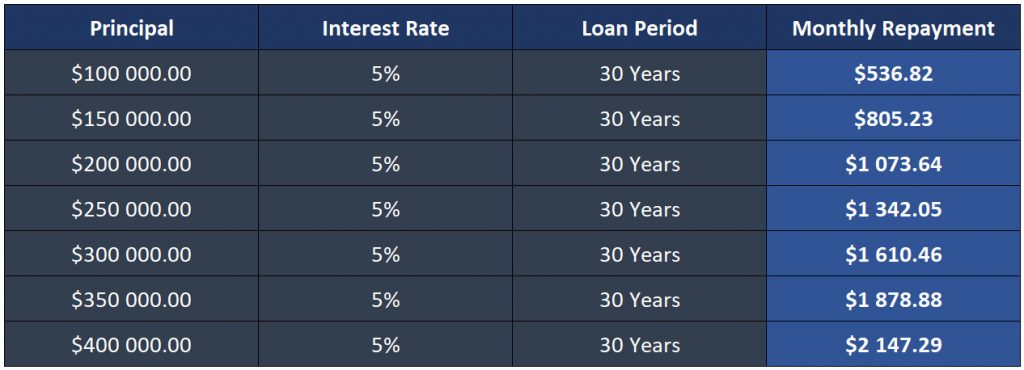

Mortgage Repayment: Your monthly mortgage repayment will depend primarily on the loan amount and the interest rate. The table below lists common repayment amounts that you can expect with a 5% interest rate.

Please note – You can use this amortization calculator to work out the expected monthly loan repayment for any amount of your choosing. It is also worth mentioning that to complete a full cash flow analysis of the property, you will need to factor mortgage payments into your final budget.

Biggest Shortcomings of the 50 Percent Rule

1 – Accuracy: The biggest weakness of this particular rule of thumb is accuracy. It’s a general rule that can give you a quick ballpark estimate for rental property expenses . However, each property on your list will require further investigation.

In other words, the 50 percent rule is a good starting point for estimating the cash flow of a potential property, but you will have to validate your estimates with significantly more detailed analysis.

2 – It can inflate expenses: Simply put, if you spend a bit of time researching properties, you should be able to find plenty of houses with operating expenses that are far lower than the 50% rule would suggest.

The most significant drawback, in this case, is that you could end up ruling out a property that actually does have the potential to become cash-flow positive.

Biggest Strengths of the 50 Percent Rule

These are the primary strengths of this real estate investing rule:

1 Speed – It should take you less than 60 seconds to use the rule.

2 Simplicity – If you know the rental income of the property , you should be able to work out the expenses in your head, by simply dividing the rental income in half.

3 Filtering properties – Using the 50 percent rule can help you disqualify properties that are unlikely to be cash flow positive, provided that is one of your investment criteria.

Final Thoughts

Ultimately, the 50 percent rule is simply a quick shortcut for a real estate investor to get a general estimate of a property ‘s operating costs. It can be very useful when used as a property filtering mechanism, but it will always just be a starting point for further analysis.

Fortunately, when you are ready to investigate your list of properties in greater detail, New Silver’s free rental property calculator can give you a more concrete understanding of the mortgage payments, cash flow , and net operating income , for the full life cycle of the real estate investment. This can give you greater confidence when pursuing your next potential property, in order to increase the passive income that you can generate with this real estate investing strategy.