If you’re shopping for a home, it’s important to know if it’s in a flood zone. Not only does it put the home at risk of extreme damage, but you’ll be required to carry flood insurance which can add significantly to your monthly costs.

But just because a property is in a flood zone doesn’t make it a ‘bad purchase’ or risky. Knowing how to find out if a property is in a flood zone and how to read the different zones is important before you buy a home.

What Is A Flood Zone?

FEMA (Federal Emergency Management Agency) maps all areas of the United States, determining its likelihood of flooding. A flood zone shows how likely the area is to flood and is broken down into zones:

- Low risk

- Moderate risk

- High risk

The flood zone is what insurance companies use to determine the premiums you’ll pay to cover your home.

How To Find Out If A Property Is In A Flood Zone

Before you buy a home, it’s important to know how to find out if a property is in a flood zone. Fortunately, the information is readily available in several areas:

- FEMA Map Service Center – This is the easiest resource to determine if your property is in a flood zone. Head to FEMA’s website and enter the property address. It will tell you if the property is in a flood zone.

- Use tax records – If your real estate agent or appraiser has access to the property’s tax records, it will show if it’s in a flood zone

- Ask your insurance agent – Insurance agents can also tell if a property is in a flood zone, and if so, which one

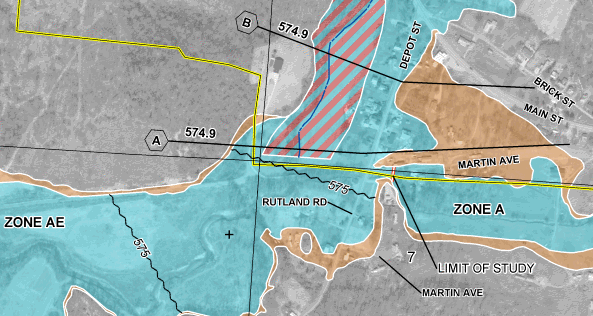

How To Read A FEMA Flood Map

When you look at the FEMA Flood Map, you’ll see letter designations for each flood zone. It’s important to know what each zone means to determine if you’re in a flood zone and if so, which zone.

The FEMA map has a map legend, but here is the breakdown:

- Zone A – This is the most common flood zone. It designates that you’re in a non-coastal flood zone. There are various types of Zone A flood zones – the type you are in determines the type of flood insurance needed and its cost

- Zone B – Homes in this area have a moderate risk of flooding

- Zone C – Homes in this area have a minimal risk of flooding

- Zone D – Homes in this area have a minor risk of flooding and/or the risk isn’t determinable

- Zone V – Homes in this area are at high risk of flooding and are in a coastal area

- Zone X – This is a newer flood zone that is actually Zones B and C

What You Need To Know About Buying A House In A Flood Zone

If you buy a house in a flood zone, you’ll need flood insurance, especially if you use any government financing, such as FHA, VA, USDA, Fannie Mae, or Freddie Mac financing. If you use any other financing including hard money lending, the bank may or may not require it – but it’s good to have either way.

If you buy a home in a low risk area, you may pay less for the home because of the flood zone. Many people avoid homes with any type of flooding risk, which makes sellers better able to negotiate.

Of course, with the benefits come risks, including:

- Flood damage is expensive and most flood insurance has deductibles

- Flood insurance may only cover up to $250,000 in damages

- Homes in risky flood zones often don’t have basements or crawl spaces because of the risk of flooding

Is It Worth Buying A House In A Flood Zone?

Like any buying decisions, you should weigh the pros and cons. How much risk can you take? What would happen if your home flooded? Can you afford the costs to repair it and the time and effort it takes including the risk of having to move out of the home is inhabitable?

For some, buying a home in a flood zone isn’t risky and buyers enjoy the savings of lower cost homes. Many people even enjoy living on the water and are willing to take the risk.

Whether or not it’s worth it is a personal decision. Look at the cost of the home, possible renovations, and for total replacement. What would it cost you and can you afford it? Are you willing to take the risk of a total loss to live in the home?

Final Thoughts

Before you bid on a home, find out its flood zone status. If it’s in a high-risk area, know the full cost of buying and maintaining the home, especially if the worst occurs and there is a flood. Find out how often floods occur in the area and what the average damage is like so you can make an informed decision on the property.