A quick summary

One of the biggest challenges facing rental real estate investors is vacancies. A high vacancy rate results in investors losing money every month, and this can quickly add up. As such, it’s important to know how to calculate vacancy rate before you purchase a rental property so that you can make an informed decision.

Key Topics

When it comes to real estate investing, rental properties are one of the most common investments to make. Not only do they offer a passive way to manage your investment, but they also provide a monthly income. Before you buy a rental property, one of the most important things to learn is how to calculate vacancy rate. This will help you decide if an investment is worthwhile or not. In this article, we’ll explain how to calculate vacancy rate, what factors affect vacancy rate and what this means for real estate investors.

Vacancy rate definition

Let’s start at the very beginning with what the term ‘vacancy rate’ refers to. Vacancy rate can best be described as a percentage that compares two numbers. First, the amount of time a property could be rented overall, second, the amount of time a property was actually rented. The rate that remains is the vacancy rate, and it shows the average amount that units in a rental property are unoccupied.

Types of vacancy rates

- Physical vacancy refers to units that are unoccupied.

- Economic vacancy refers to the amount of rent that wasn’t claimed for the unit, versus the amount that could’ve been claimed as a result of vacancy.

- Market vacancy rate refers to the average vacancy rates in the area, for different types of properties.

How does this help real estate investors?

Determining the vacancy rate of a property is a good way to tell if the property is likely to be a successful investment and earn enough to be sustainable and profitable, or if it’s likely to underperform. So, this metric is a vital one for real estate investors to make more informed purchase decisions.

Why would a property be vacant?

- During the time between a tenant moving out and another one moving in.

- If there are any repairs or renovations that need to be done on a unit.

- If the rental rate is too high and potential tenants are put off by that.

- If the property is located in an area where rental demand is low due to various factors.

How to calculate vacancy rate

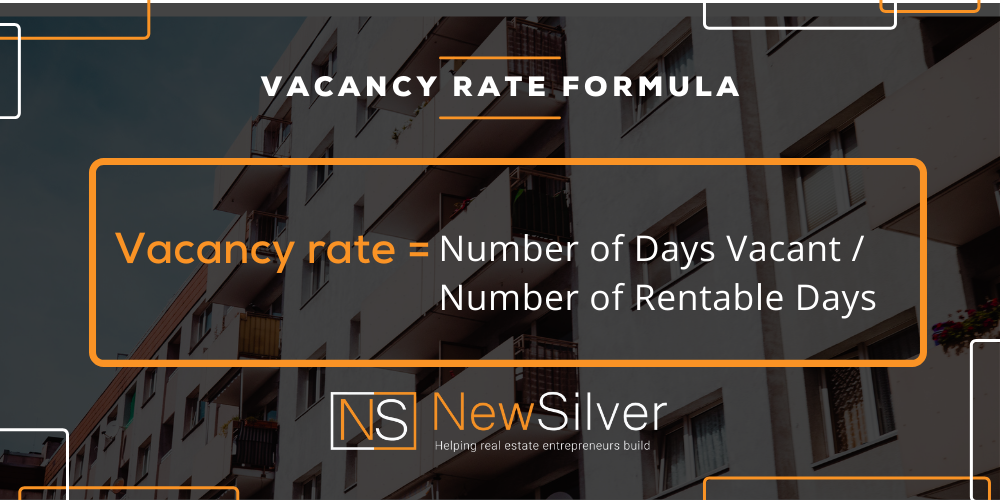

Vacancy rate formula

Vacancy Rate = Number of Vacant Days / Number of Rentable Days * 100

Your first step is to find out more about the real estate market in the area and get the rental amounts of similar houses in the neighborhood. It’s also worthwhile finding out the vacancy rates in the area from local real estate agents, developers or HomeOwners’ Associations. The vacancy rate formula, as illustrated above, can be calculated by the following examples.

Vacancy rate example

Single-family properties and multi-family properties have slightly different vacancy rate calculations. So, let’s look at an example for each.

Single-family property

These are typically one unit, so the vacancy rate is calculated by using two amounts. The total amount of time that the property sat vacant over a specific period, and the amount of time that the property could’ve been rented out.

For example:

To work out physical vacancy… If the unit was vacant for 8 weeks out of the year (52 weeks), you’d divide 8 by 52, and your vacancy rate would be 15.38%.

To work out economic vacancy… You would divide the total amount of rent lost, by the total amount of rent that you could’ve collected over the time period. Let’s say you lost $500 per week, and you could’ve made $26,000 that year, your economic vacancy would then be 15.38%.

Multi-family property

Due to the fact that a multi-family property has multiple units, you’ll need to take these into account in your vacancy rate calculation.

For example:

Multiply the current number of vacant units by 100 and then divide this by the total number of units on your property. So, if you owned a building with 20 apartments in it and 4 of them were vacant, you’d multiply 3 by 100 and then divide this by 20, which would give you a vacancy rate of 15%.

What factors affect the vacancy rate of a rental property?

Vacant units are one of the biggest challenges for real estate investors, so it’s worth paying attention to the factors that affect the vacancy rate of a rental property so that you can work out how to avoid this as much as possible, or if it happens, figure out what could’ve caused it.

- The growth or decline of businesses in the area based on the local economy – which leads to more or less available jobs based on whether businesses are thriving or not.

- The overall economic stability of the area – which goes hand in hand with what people can afford and whether they rent or buy properties .

- Real estate market conditions in the area – which can lead to an increase or decrease in vacancy rates based on the rental market conditions.

- The quality of life in the area – which could either attract tenants or put them off as the quality of life may fluctuate, it includes safety and security as a major factor.

- Accessibility – ease of access to transport and other amenities plays a big role in attracting and keeping tenants.

- Interest rates – these can either lead to an increase in vacancy rates when they are low because people will be more interested in buying homes, or a decrease in vacancy rates if interest rates are high and people are more attracted to renting than buying.

- Zoning regulations in the area – if new developments cannot be done, the rental demand will increase which leads to lower vacancy rates and higher rental prices.

- Property management – if a property is managed well and tenants are happy, the vacancy rate will be lower, however if it’s managed badly, vacancy rates will rise.

What is a normal rental vacancy rate?

Vacancy rate is usually measured over a period of 1 year, and it varies greatly from city to city across the country because the real estate market and economic conditions are very different in each area. The average vacancy rate for rental properties in the US is 7%, according to MashVisor, however this is much higher in some cities and much lower in others so it’s a good idea to compare your property’s vacancy rate to the local one.

For metropolitan areas, anything from 2% to 4% is usually considered a good vacancy rate, however this also depends on the type of property because vacancy rates change according to the type of property. According to MashVisor, these are the average vacancy rates for each rental property type:

- Short-term rental (such as AirBnb): 30%

- Vacation rental: 45%

- Multi-family property: 5.5%

- Single-family property: 5%

- Apartment buildings: 4.7%

How to reduce the vacancy rate of your rental property

Here are 5 great ways to reduce the vacancy rate of your rental property and keep your tenants around longer:

- Market your rental property at the right time: There are certain times of the year, in certain areas, where the rental market slows down and this is not a good time to be looking for a tenant. Rather try when the market has picked up again, to ensure that you find a tenant who will stay.

- Offer a longer lease: You can increase your lease period beyond the standard 12-month lease. A 2- or 3-year lease is riskier for both the tenant and the landlord, but it could solve the issue of vacancy during that period of time, and another benefit is that you won’t need to find a new tenant every year.

- Thorough tenant screening: At the outset, make sure to screen your tenants adequately, by doing credit checks and background checks, to reduce your risk of getting a bad tenant who will default and leave you with a vacant property.

- Find out tenant intentions: Ask your tenant well before their lease ends about whether they intend to stay or leave, so that if they are planning on leaving, you have ample time to find another tenant and your property won’t stand vacant.

- Maintain the property: Keeping the property in good condition involves doing the necessary repairs and maintenance to make it a better space to live in. Your tenants are likely to stay longer if the property is well maintained.

Closing thoughts

Vacancies in rental properties are inevitable, so it’s important to prepare for this and have a plan in place for the time when a unit or units may be vacant. Investors typically aim to keep their vacancy rate as low as possible of course, because this has a direct impact on their return on investment. Understanding the situations that can lead to a higher vacancy rate is a good foundation to ensuring that the rate stays low or finding solutions as to why its risen. By keeping tabs on your vacancy rate however, you can compare your property to the current market average and try to keep it as low as possible.