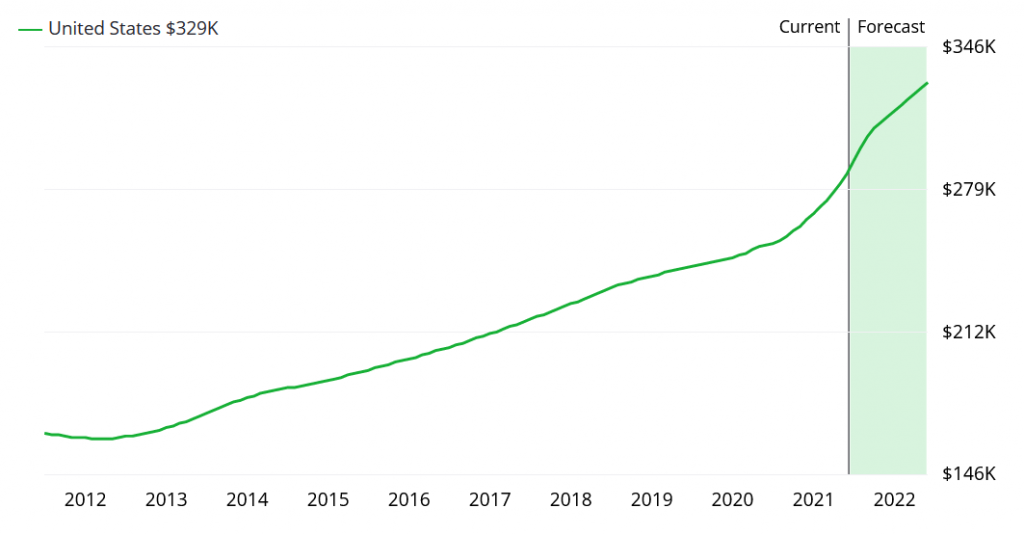

To flip a house, you will need access to capital. For instance, data from Zillow indicates that in 2021, the average home value in the US is $287,148, and this price is predicted to move beyond $300,00 over the next year:

Even though it is common for house flippers to focus on less expensive homes, the simple reality is that you are likely to need anywhere from $100,000 to $400,000 to fund a house flip. Most real estate investors don’t have this amount of capital readily available, which is why they have to borrow money to flip a house.

In this guide, we will outline some of the most tried and trusted methods for securing the capital needed to flip a home successfully.

1. HARD MONEY LOANS

Hard money loans have become extremely popular in the US because they offer a quick and reliable way for real estate investors to borrow money. Instead of having to beg and plead for a house flipping loan with a traditional lender (that will more than likely reject your application anyway), hard money lenders are far more likely to approve your application for funding.

For many real estate investors, hard money loans represent the default choice when they have identified an opportunity and need to act fast to secure deal.

Pros of hard money loans:

- Your application is likely to be approved if you have a good credit score and you’ve identified a profitable house flipping opportunity

- House flipping experience is not required, but it is advantageous

- Hard money lenders process applications very quickly. It entirely possible to secure funds within 7 business days, and you can get proof of funds instantly in some cases

- If you work with a reputable lender, they can become a trusted knowledge resource, pointing you in the right direction when you need answers to important questions

Cons of hard money loans:

The interest rates are higher than traditional loans: The main reason for the higher interest rate (relative to a standard mortgage agreement) is risk. Property flipping is considerably riskier than investing in a home that you intend to live in. For instance, the renovations could be more expensive than you budget for, the project might take longer than expected, and you could experience difficulty when trying to sell the house. All of these risks (and many more) are at play when you flip a house. Using the asset as a collateral and setting a higher interest rate is how hard money lenders mitigate the risks involved in this business.

The loan terms are short, which can put pressure on the investor to complete the project: Unlike normal loans which usually have terms ranging from 15 to 30 years, most hard money loans have terms ranging from 8 to 24 months. This is important, because you are required to pay back the full loan amount at the end of the loan’s life cycle.

You could end up losing the house to foreclosure: This is by far the biggest risk when funding a fix and flip with a hard money loan. If you fall into arrears with your payments for a sustained period of time, the hard money lender is legally entitled to claim the house in order to cover the cost of the loan that was provided. This means that you would lose the deposit that you put down, ownership of the house, and all property expenses that you incurred during the project, including closing costs.

2. USE YOUR HOME EQUITY

Even though traditional mortgage providers are unlikely to give you a house flipping loan, tapping into your existing home equity is a popular workaround that investors should consider. There are two approaches that are suitable for funding a flip if you are house rich (meaning you have a substantial amount of equity in your home).

Option 1: Home Equity Loan

A home equity loan is effectively a second mortgage that sits on top of your existing mortgage. For example, if your home is worth $300,000 and your mortgage balance is $200,000, you could potentially raise an additional $100,000, using a home equity loan. In this scenario, you would:

- Continue to pay off your existing mortgage

- Start paying off your second mortgage after it has been finalized

Option 2: Cash Out Refinance

Unlike a home equity loan, if you opt for a cash out refinance, your existing loan is essentially replaced by a larger mortgage based on the current value of your house. Crucially, you get to cash out the difference between your mortgage balance (how much you owe), and the value of the house. In other words, the equity that you have in the home becomes available to you in the form of cash, which you can spend however you see fit.

Given that covid-19 has resulted in historically low interest rates, cash out refinance is a particularly attractive option at this moment in time, provided you have home equity to play with. You could potentially drop the interest rate on your mortgage and access the capital needed to purchase an investment property.

Pros of Using Your Home Equity

- Traditional Lenders are likely to approve your application

- The interest rate will be lower than a hard money loan

- You could increase your net worth if you invest the equity available to you wisely

Cons of Using Your Home Equity

- You need to own a home that has appreciated substantially over time

- The equity available to you might not be enough to purchase another property

- If you choose the cash out refinance option, it’s possible that your mortgage rate could increase (this depends on the mortgage rates available at the time when you apply)

3. CROWDFUNDING FOR REAL ESTATE

While most people are familiar with crowdfunding platforms like Kickstarter, GoFundMe and Indiegogo, they might not realize that there are also crowdfunding platforms specifically for real estate investors. There are a number of companies that offer this service, including:

- CrowdStreet

- DiversyFund

- EquityMultiple

- Fundrise

- PeerStreet

- RealtyMogul

- FundThatFlip

You can find a full list of crowdfunding sites here.

Pros of Crowdfunding For Real Estate

- You can use these companies to invest in your behalf (you just need to provide the capital)

- Certain crowdfunding platforms offer loan packages that are comparable with hard money lenders

Cons of Crowdfunding for house flipping

- There aren’t that many companies that specialize in loans for people who flip houses

- They are more geared toward hassle free buy-and-hold investing

- These platforms can be completely automated, leaving no room for negotiation

4. PRIVATE LENDERS

It is surprisingly common for people to assume that a private lender and a hard money lender are one and the same thing, even though they are completely separate sources of capital. A private lender is simply an individual that has a substantial amount of capital that they are willing to lend to you. In most cases, private lenders take the form of:

- High net worth individuals that you have a good relationship with

- Family members

- Highly established real estate investors that have more money than time

If you want to turn the best possible profit with your house flip, finding a private lender with real estate investing experience is ideal. In addition to lending the capital you need to fund the project; they can also offer guidance and help you accurately assess the potential ROI of the deal.

Pros of private lenders

- You can potentially get an interest rate that is comparable to traditional mortgage

- They can provide business insight and investing advice

- They may offer terms that are more favorable than a bank or hard money lenders

Cons of private lenders

- If the project goes badly, it could completely destroy your relationship with the private lender

- They aren’t necessarily easy to access. You may have to attend real estate networking events to s

- They might reject your proposal. There is no guarantee that a private lender will actually give you the funds

- It can take an extremely long time to find an investor that is willing to work with you

FINAL THOUGHTS

It should be pretty clear that there are a number of ways to borrow money to flip a house. You access capital through:

- Hard Money Lenders

- Cashing In Your Home Equity

- Crowdfunding platforms

- Private lenders

While there may be other channels available (including your own savings), these are by far the most common avenues for real estate investors that are ready to move forward with a house flipping project.