Calculating how much house you can afford is relatively straightforward if you just want a basic estimate based on your current salary. For instance, one quick rule thumb is to multiply your annual salary by 2.5 (or 3 if you have a good credit score). With that being said, you can also achieve a more accurate estimate, using some simple debt-to-income ratios.

The goal of this post is to outline the debt-to-income ratios that most US banks use when calculating your recommended mortgage amount. We will be using several user-friendly charts and examples to help solidify a few key points.

Table of Contents

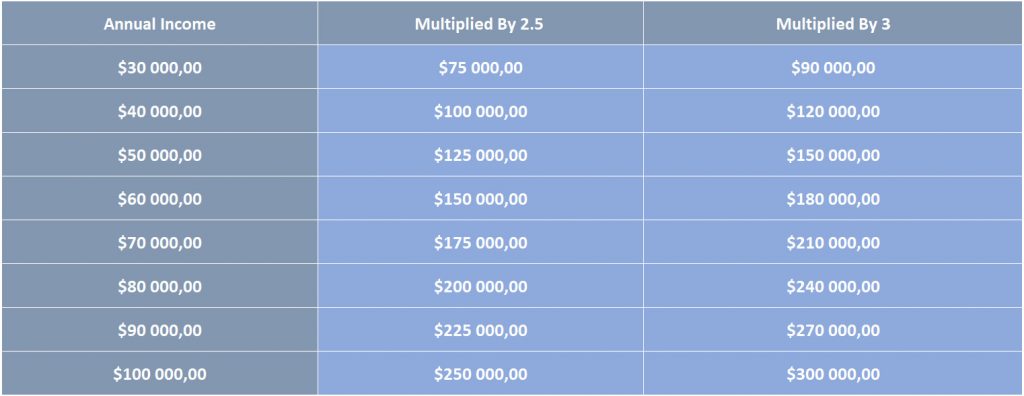

Quick Rule Of Thumb: Multiply Your Annual Salary By 2.5 or 3

The quickest way to work out how much house you can afford is to multiply your annual pre-tax salary by 2.5 or 3. If you want a conservative estimate, use 2.5. If you want a more aggressive estimate, use 3. You can see how simple this is to do by taking a quick look at the table below.

Using this simple method allows you to quickly work out a potential mortgage amount based on your current salary. Naturally other factors will influence the final bond amount, but this is the place to start if you’re still just browsing for houses.

Also, it’s worth mentioning that the recent drop in interest rates (due in part to Covid-19), means that multiplying by 3 (and even higher multiples) is now more realistic for American’s with a stable income.

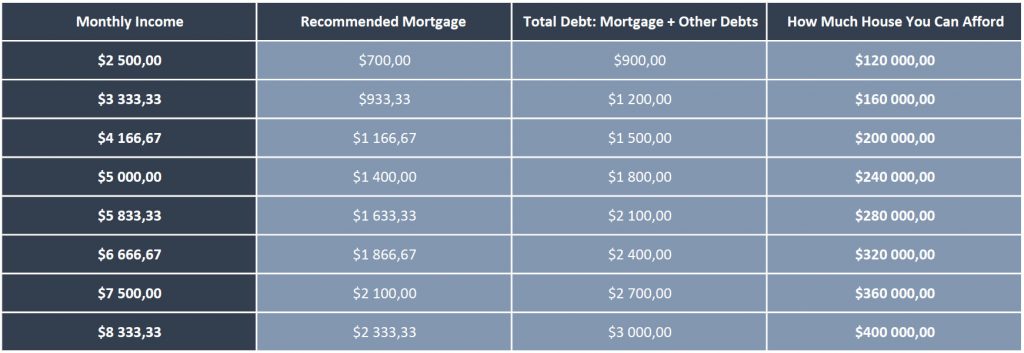

The More Accurate Method: Using The 28/36 Rule

The 28/36 debt-to-income rule is effectively the default recommendation that most banks in America support. According to the 28/36 rule:

28% – Your mortgage repayment should not exceed 28% of your monthly pre-tax salary

36% – Your total debt obligations should not exceed 36% of your monthly pre-tax salary

Again, this is easier to demonstrate with a table, so you can get a feel for what certain salary brackets can afford.

Please note, the table above assumes a 5% deposit on the house. Also, you might find that your total debt (mortgage + other debts) is much higher than the table suggests. If that is the case, it will reduce how much house you can afford and your monthly mortgage repayment.

The team from Smart Asset has summarized the 28/36 rule quite nicely. In essence “for every pre-tax dollar you earn each month, you should dedicate no more than 36 cents to paying off your mortgage, student loans, credit card debt, and so on.”

Can You Break The 28/36 Rule?

While the 28/36 rule is a reliable guideline, it is not an immutable law that banks are obliged to follow. It’s convenient to think of the 28/36 total debt rule as the starting point on a sliding scale.

If you have a poor credit score and lots of existing debt, banks might view you as a high-risk individual and grant you a bond that is less than 28% of your pre-tax salary.

Conversely, if you have no car repayment, low student debt, and a good credit score, you could definitely qualify for a mortgage that is more than 28% of your pre-tax salary.

Factors which can decrease your maximum mortgage

- Large car repayment

- High student loan debt

- High credit card debt

- Low income

- Poor Credit Score

Factors which can increase your maximum mortgage

- Small or no car repayment

- Manageable student loan

- Little to no credit card debt

- High Income

- Good Credit Score

What Is Debt-To-Income Ratio?

Debt-to-income (DTI) ratio is the percentage of your pre-tax income that is allocated to paying off debt. Debt-to-income is the basis of the 28/36 rule and it is the primary determinant of how much house you can afford, based on your existing income.

As mentioned earlier, other variables like credit history affect your maximum mortgage amount, but your individual DTI ratio is definitely the most important element in the equation.

How To Calculate Debt To income Ratio

Debt-To-Income (DTI) = Debt / Income * 100

Debt-To-Income Ratio Example

To further illustrate this formula in action, let’s use an example of someone who earns $5,000 per month, and has total debts of $1,800.

- Monthly Debt: $1,800

- Monthly Income: $5,000

- DTI = Debt/Income * 100

- DTI = $1,800/$5,000 * 100

- DTI = 36%

It’s clear to see that in the example above, the individual has a DTI of 36%. This is perfectly inline within the recommended range. Also, you can work out your DTI using monthly amounts, or annual amounts.

5 Tips For Getting A Better Interest rate

If you want to save yourself a huge amount of money before you decide to invest in a house, improving your credit score is arguably the most effective way to do so. This is because your credit score will impact the interest rate that a bank is willing to offer you.

On the surface, this might not seem like a big deal, but when you factor in 30 years of compounding (the standard length of a home loan in the US), the difference quite literally becomes exponential.

1. Always Pay Your Bills On Time

It might not seem like such a big deal, but missing a single payment can negatively affect your credit score. The underlying concern is your financial reliability. From a financial perspective, people who miss payments often are less reliable than people who never miss payments.

Credit score companies use this data to calculate your final number, be it good or bad. If this is something that affects you, it could be wise to start an emergency fund in order to prevent late payments in the future.

2. Never Max Out Your Credit Card

Maxing out your credit card is a big red flag for potential lenders. Your credit utilization is the second most important factor in the credit score calculation, so it is in your best interest to stay well within your limits when using credit.

To be more specific, aim to use 30% or less of your maximum credit allowance. By following this guideline, you can quite literally increase your credit score over time.

3. Start Building Your Credit Profile As Soon As Possible

One of the biggest issues that many Americans run into when applying for a first time home loan is a ‘thin credit profile’.

According to Investopedia, there are approximately 62 million US citizens that have this very problem. The challenge for people with a thin credit profile is that credit score companies don’t have enough data points to generate an accurate score.

Fortunately, there are ways to combat this, namely:

Use Experian Boost or UltraFico – These services factor in non-credit variables like banking history and utility payments to start building your credit score.

Use Your Rent Payments To Build Your Credit Score – Companies like Rental Kharma and RentTrack are designed to help you do this. Provided you pay your rent on time, you can start building a positive credit history, even if you don’t have a credit card or utility payments.

4. Make Lump-Sum Payments Toward Your Car Or Student Loan Debt

As mentioned earlier in the article, your debt-to-income ratio is the most important factor in how much house you can afford. Based on this, it makes perfect sense to clear as much of your existing debt as possible, before you apply for a home loan.

Paying off existing debt can increase the percentage of your total debt that is allocated to your home loan, and it can also improve the interest rate that a bank is willing to offer you.

5. Save For A Big Deposit On The House

Saving for a large deposit is one of the best things you can do when trying to buy a home. By putting money away for a big deposit you can:

- Increase the maximum mortgage amount that banks are willing to offer you

- Decrease the interest rate that you pay for the duration of the loan

- Decrease your monthly repayment and increase your monthly cash flow

All of the benefits listed above will have a favorable effect on your financial well-being over the short term and the long term. In other words, putting down a big deposit is one of the best things you can do, provided you have the discipline and financial means to do it.

Final Thoughts

In the end how much house you can afford is primarily dependent on your debt-to-income ratio and your financial track record. Fortunately, by practicing good financial habits, you can improve both of these attributes over time.

Furthermore, interest rates in the US have dipped to some of the lowest levels in over 20 years in response to the Covid-19 pandemic. This is good news for aspiring home owners, because you can potentially buy a more expensive home, knowing that your monthly repayment will be manageable due to the lower interest rate.

Lastly, it can also be helpful to run your salary and debt figures through a home affordability calculator. This can help give you an even more detailed understanding of your potential mortgage amount.

Frequently Asked Questions (FAQ)

How much house can I afford with 40,000 a year?

With a $40,000 annual salary, you should be able to afford a home that is between $100,000 and $160,000. The final amount that a bank is willing to offer will depend on your financial history and current credit score.

How much house can I afford if I make 100,000 a year?

With a $100,000 annual salary, you should be able to purchase a home between $250,000 & $400,000. Again, this will depend on your credit score and your existing debt obligations. For instance, if you have a big car repayment, this could decrease your maximum mortgage amount.

Conversely, if you have no car repayment, you could potentially qualify for an even bigger loan.

Do you have to make a down payment?

There may be some financial institutions that don’t allow a down payment, but most banks will require you to put down a payment of at least 3%. Ideally, you should aim for a down payment that is 20% or more of the property value. Naturally, this might not always be possible, but it is a good target to aim for.

How much can I afford on a house based on my salary?

As mentioned at the beginning of the article, the quickest way to estimate how much house you can afford based on your salary is to simply multiply your annual salary by 2.5 (or 3 if you have a good credit score).

Alternatively, you can multiply your monthly pre-tax salary by 0.28, to quickly estimate a guideline mortgage repayment.

What if your income level is inconsistent?

If you are a freelancer with an inconsistent income, it could negatively affect the total mortgage that lenders are willing to give you. Having said that, if your annual income as a freelancer is relatively stable, it stands to reason that banks will consider your income over multiple years when determining your potential mortgage amount.

How much do I need to make to afford a 250k house?

To afford a $250k house, you will need to earn between $5,000 and $7,000 per month, assuming your existing debts are under control and you have a good credit score.

How does your credit score affect how much house you can afford?

Simply put, the better your credit score, the higher your maximum mortgage will be. A good credit score can also help you agree to a lower interest rate with the bank. Over a period of 30 years, a reduced interest rate can save you a huge amount of money.