A brief summary

Much like the rest of the US, the housing market in Hawaii has been volatile since the start of the pandemic. This volatility has led to new trends and changes in the real estate market. Read on to find out our Hawaii housing market forecast for 2022.

Table of Contents

Hawaii is one of the most attractive places to live in the US, and also one of the most expensive. In light of this, people have been flocking to the beautiful islands of Hawaii for a long time. Over the last 2 years however, the housing market has been fluctuating along with rising and falling interest rates. What’s next for the Hawaii housing market forecast for 2022? We’ll take a look at this and more below.

Hawaii home prices

Average home price in Hawaii

According to World Population Review, Hawaii is one of the most expensive states in the US to live. However, on the plus side, the state has one of the lowest poverty rates. The housing market since 2020 has been the hottest that the state has ever seen. The median home prices in Hawaii increased a whopping 22% between 2020 and 2021.

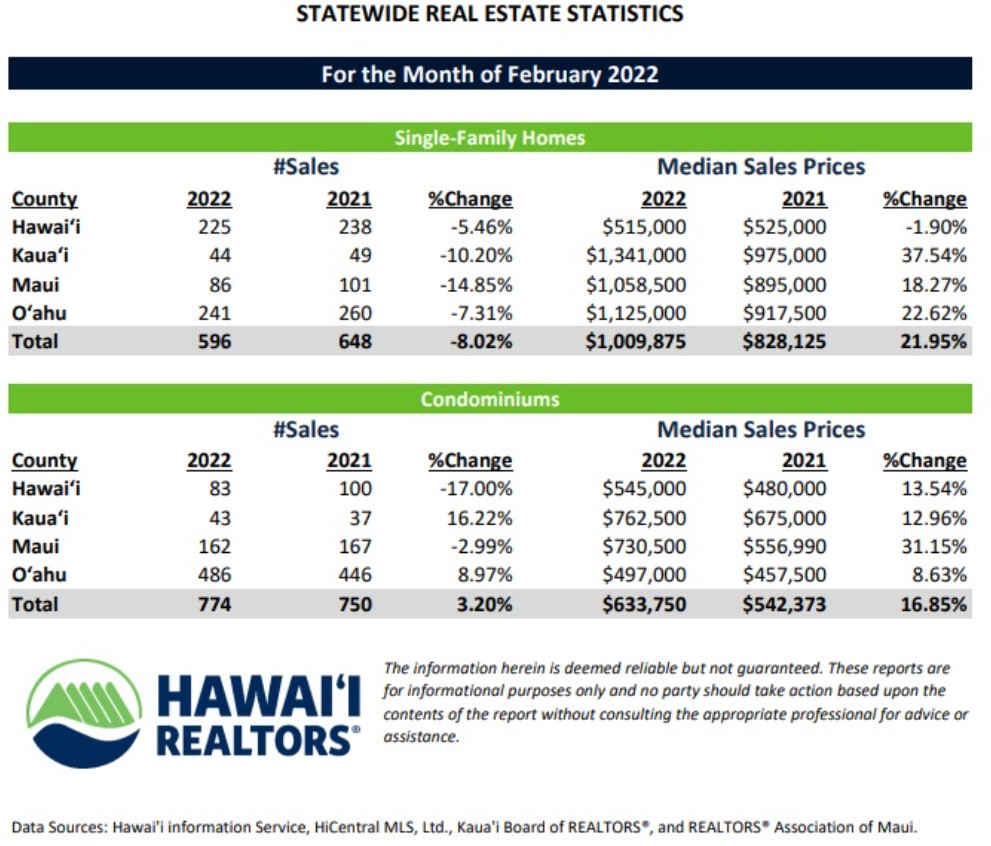

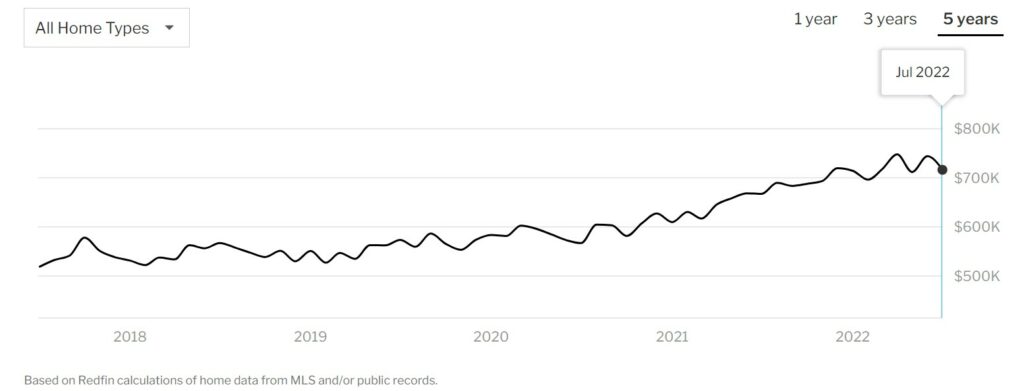

The median sales price in Hawaii in 2021 topped $828,125 and in 2022 it cumulatively topped just over $1million across the 4 main islands. While the median sales price overall for Hawaii was $717,200 in July 2022. The price of condo’s has also continued to rise, with no signs of the Hawaii housing market slowing down.

Hawaii housing prices graph

The housing price graphs below reflect the Hawaii house prices over the last few years, supplied by Hawaii Realtors and RedFin.

Honolulu home prices

The housing affordability index for Honolulu is currently sitting at 74.80, which is an 8.09% increase, year-on-year. The large metropolitan in Hawaii has been ranked as the third least-affordable market across the US with Oahu’s median home prices surpassing $1million in 2022.

With the rise of the pandemic in March 2020, home prices in Honolulu began their upward trajectory. The phenomenon began thanks to local buyers looking for larger homes as people began staying home more, as well as mainland buyers moving to the islands to work remotely.

The typical home value in Honolulu, according to Zillow, is $875,952, and these values have increased by 12.9% over the last 12 months. While this may be the typical home value, the median sales price in Honolulu in July 2022 was $577,000. 364 homes sold in Honolulu in this time, and the median days on the market were 53, as of July 2022.

Hawaii housing market statistics

Median Sales Price

$717,200

Days on Market (Average)

54 Days

Housing Affordability Index

849.52

Total Home Sales

1,251

Population Size In State Name

1.4milion

Median Household Income

$83,173

Mortgage Rates (30-Year Fixed)

5.77%

Unemployment Rate

4.1%

The population size in Hawaii is 1.4million. Hawaii is made up of 8 major islands, with Oahu being the largest. The population in Oahu is 953,207 as of 2022. The second largest island is Hawaii, with a population of 186,738 and the third largest is Maui, with 166,738 people.

Hawaii falls in the top 10 highest median household income brackets in the US, at $83,173. Hawaii still falls short of the top spot, which is taken by Maryland, with a median household income of $94,384. Honolulu County and Maui County take the top spots of the richest areas in Hawaii.

The housing affordability index rating for Hawaii is 849.52. A steep incline from the 652.15 rating the state received in Q2 of 2020. This is an indication as to the level of affordability in the state, which is not one of the most affordable states in the country.

There were 1,251 home sales in Hawaii in July 2022. This was a decrease of 28.7% from last year, when 1,754 homes were sold in July. This comes after major mortgage rate hikes and pandemic-related effects hit the real estate market.

On average, homes spent a median number of 54 days on the market in Hawaii in July 2022. This is decrease of 8 days, from last year’s number of days which was 62. Which means that, even though less homes were being sold in the state, they were being sold quicker than last year.

The median sales price in Hawaii is $717,200 in July 2022, which was an increase of 7.5% from July 2021 home sales price. This comes in the wake of the changing real estate market which saw home prices rise drastically over the last year.

As of August 2022, mortgage rates for a 30-year fixed loan in Hawaii were 5.77%, and for a 15-year fixed loan were 4.78%. Hawaii is known for its higher cost of living and higher home values. Hawaii’s mortgage rates are currently higher than the national average.

The unemployment rate for Hawaii is 4.1%, which means there is a total of 27,000 people unemployed in the state. 6,700 unemployment insurance claims were made so far in 2022. In April 2022, the unemployment rate sky-rocketed to 22.4% in light of the pandemic, but the state has made a solid recovery on the employment front since then.

*Resources for all data in this article can be found below

Predictions for Hawaii housing market in 2022

Hawaii real estate market trends

Hawaii’s piping hot real estate market is not expected to cool any time soon as a result of rising mortgage rates, according to real estate experts. However, buyer behavior may change instead. Housing inventory is declining across the state, and mortgage applications have dropped by 40% over the course of 2022.

Hawaii has become a buyer’s market as the demand for real estate is declining, therefore sellers aren’t selling their houses as fast. While home sales have been falling over the last few months in Hawaii, prices have not dropped. However, the signs point towards a recovery from sales even with mortgage rates on the rise.

Will the Hawaii housing market crash?

Talk of housing market crashes are rife across the country, based on continued rising interest rates and therefore mortgage rates. However, the Hawaii housing market is poised to continue being robust even with the current real estate market turmoil. Low inventory may push home prices even higher, and as it stands the amount of activity continues to be at an increased level.

Where to find affordable housing in Hawaii

Affordable housing in Hawaii can be harder to find but there are a few areas where first-time buyers or new investors can find housing at lower prices.

Hilo

Hilo offers residents a city lifestyle without the hustle and bustle, or the high city prices. Hilo is situated on the Big Island and is one of the most popular spots for volcanoes as it’s home to the Volcano National Park. The median home price in Hilo is $318,000, which is less than half of the state median home price. The cost of living in Hilo is 28% lower than the overall cost of living in Hawaii.

Waimalu

Waimalu is located 22 minutes away from Honolulu by car. So, residents can experience the buzz of Honolulu, without the high home prices. Waimalu has the Pearlridge Center, one of the biggest indoor malls in Hawaii and historical sites located nearby for tourists. Waimalu is just a few minutes away from Waikiki beach. The median home price in Waimalu is $446,800 which is lower than the state average, but still higher than the national average. Waimalu is number 1 on the list of Best Suburb for Young Professionals in Hawaii.

Wailuku

Wailuku is situated in the beautiful island of Maui. The small town gives residents a relaxed way of life with surrounding natural beauty. Wailuku is one of the most affordable places to lives in Hawaii, with a median home price of $463,500. This is also below the national average, and Wailuku has a median monthly rent of $1,069.

Hottest housing markets in Hawaii

For those who are interested in the hottest housing markets in Hawaii, here are some of the markets creating the biggest buzz.

Honolulu

Honolulu continues to be one of the country’s hottest housing markets. While inventory levels are lower than usual here, the city continues to bustle and the real estate market thrives. The median home list price in Honolulu is $849,000, which is a 23.5% increase when compared to the same period last year.

Pearl City

The median property price in Pearl City comes in at a tidy $733,300, however property values in this area have grown by 3.2% over the last year and are predicted to grow another 0.2% over the next year. Pearl City has a median household income of $91,122, one of the biggest in the state. Pearl City is situated on the island of Oahu and along the north shore of Pearl Harbor.

Kahului

The Kahului area beat the national average for median home price growth, topping 7.2% recently. Kahului ranks amongst the top places in Hawaii for house appreciation growth, making it one of the hottest housing markets in the state. The area is expected to perform even better than the national average next year, with a forecasted growth of 4.3%. Median home prices in Kahului are $642,500, and the median household income grew by 7.38% over the last year.

The bottom line

Hawaii offers home buyers an island lifestyle, coupled with the hustle and bustle of city life if they so choose. The great quality of life that these islands offer residents is a major drawcard, and the housing market adds to this drawcard. Investing in property in Hawaii could be a great option for some investors as the market shows no signs of crashing in the near future.

*Resources: World Population Review, Redfin, Bank rate, Zillow, Bureau of Labor Statistics, KHON, Ycharts, FRED, ManageCasa, Hawaii Business, Upnest, Realtor.com, List with clever