Investing in rental properties is a great way to earn steady passive income and even a bit of profit, especially when owning more than one at the same time. This income covers expenses like loan repayments and maintenance, and when managed well can help the investor to achieve complete financial independence, making it a popular investment strategy.

For rental property investors to ultimately be successful, they need to be familiar with all the parts of the real estate process, including what it’s like to sell the property and the in’s and out’s of the tax process.

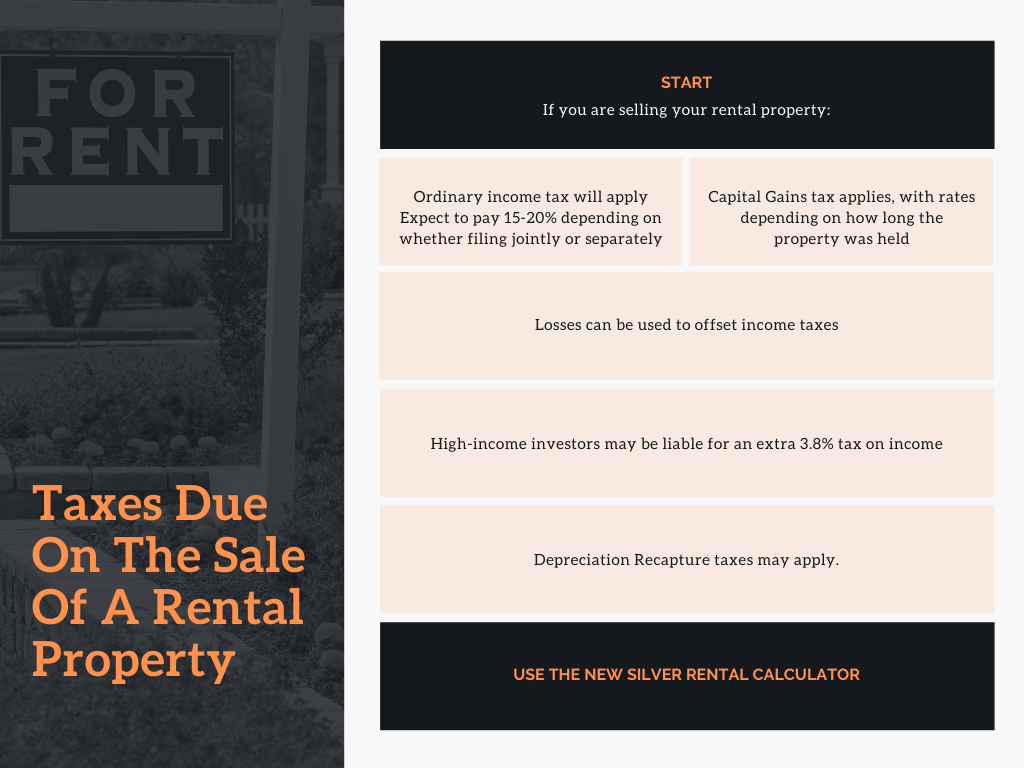

When the investor does decide to sell their rental home, they can make substantial profits. The caveat is that when rental homes are sold, the investor can incur significant tax liabilities that can quickly become expensive and eat into those profits. For example, the current tax rate is 15% if the investor is filing jointly as part of a married couple, but over certain income thresholds, the percentage can go as high as 20% for properties held over a year (and taxed as ordinary income if held for less than twelve months). That doesn’t include other applicable taxes that the investor may be liable for.

So, how much tax will you ultimately have to pay when you sell your rental property, and is there a legal way to reduce them? We have you covered. Keep reading for our full guide to gain a better understanding of rental property tax and how to minimize it:

Rental Property Tax Basics

The first and foremost thing the investor needs to know is the basics of taxes around rental homes.

The sale of a rental property is taxed differently to the sale of primary residences, which is why doing prior research is essential. Tax authorities consider rental properties to be business assets due to the consistent earning of income, and as a result, the income made from the sale will be categorized as either a ‘gain’ or a ‘loss’. Any income earned from the sale of a rental property is subject to normal income tax to start with. Once the property is sold, the amount earned by the investor will also be subject to capital gains tax.

When you’re selling a primary residence, the profits made from the sale are not taxable up to a certain amount the seller brings in. Once it passes that threshold, the profits made are classified as capital gains and taxed accordingly, at rates that can differ from ordinary income tax.

So what do gains and losses represent in terms of tax? Well, taxes are due on gains made from the sale of the rental home, while losses can be written off to offset the investor’s taxable income instead. What’s key here is that there are different types of gains, and the taxes due on them may differ.

Different Types Of Gain

Gains in real estate sales are typically classified as either ordinary or capital gains. Business assets like rental properties are considered to be ordinary gains. Gains on houses bought and sold for the purpose of profiting off of price appreciation are considered to be capital gains. These are taxes payable on assets held over a certain period of time

In addition to that, the IRS distinguishes between gains made from depreciation and appreciation, meaning both capital gains and ordinary gains could apply to the investor’s property sale.

If the rental property has made a loss, it will be classified as an ordinary loss and can result in up to $3,000 being offset from the investor’s ordinary income during the tax year. A loss takes place when the investor’s expenses are higher than their income made from the property they are renting out. Because this loss is considered to be ‘ordinary’, it can be fully deducted, decreasing the amount of tax the investor is liable for.

Understanding Capital Gains Tax

There are two different types of capital gains taxes, both subject to different taxation rules. The capital gains rate the investor is liable for will depend on how long the investor has owned the property. During 2020, capital gains tax rates ranged between 0-20% on assets held for a period of longer than one year. Assets held for under a year, on the other hand, are subject to capital gains tax that correspond directly to ordinary income tax brackets.

The two types of capital gains tax are short-term and long-term. Short-term capital gains tax will apply if the property has been owned by the investor for less than a full year. These gains are taxed on the same basis as ordinary income, so the investor pays an amount calculated based on their income bracket.

Long-term capital gains apply if the investor has held the property for longer than a year and is taxed at a more favorable rate of 0 to 20% as mentioned above.

It’s important to note that taxpayers that are in the high-income category may also be liable for an additional 3.8% tax on their net investment income – this amount is applicable whether the gains are considered to be short or long-term. The thresholds for this additional tax are $200,000 if filing alone, $250,000 when filing jointly with a spouse, and $125,000 when filing separately while married.

Capital gains not only apply to real estate but also to other assets such as stocks, bonds, cars, and other investments.

Depreciation Recapture

Another form of tax the rental property investor will have to prepare for is depreciation recapture. It’s well-known that property depreciation can be written off as an expense.

When a property with depreciation is sold, the funds that would have been written off are due to the IRS instead. You can think of depreciation recapture as having similar characteristics as an IRA. With an IRA, the investor can deduct the contributions they have made on their tax returns. When the funds are withdrawn from the IRA, they become taxable income.

An investor can depreciate a rental property only if they hold the title deed, the property is used to generate income and it has some sort of lifespan. In real estate, properties can experience deterioration in the form of decay or disrepair. Finally, the IRS will require the property to be held for over a year.

It’s important for investors to note that depreciation will apply to the physical structure only. The land it is built on cannot fall into disrepair or become obsolete, and as a result, it is not considered to be depreciable.

To gain a better understanding of depreciation recapture, it helps to look at some examples. Let’s say the investor held a rental home over a period of five years, writing off the depreciation of $5,000 per year. That means that once the investor sells the property, they’ll be liable for $25,000 in depreciation recapture taxes. The amount becomes cumulative. Depreciation recapture is then taxed at the investor’s regular income tax rate. The IRS considers the property to be suitable for depreciation from the first day it is officially in ‘service’, meaning paying tenants have moved in.

How To Decrease Taxes On The Sale Of Rental Properties

There are several methods by which investors can legally reduce the amount of tax they are due to pay when selling their rental property.

In terms of capital gains tax, there are several strategies investors make use of. One is to live in the rental property themselves for a set period of time, allowing them to be included in a category known as ‘excluded home sales’. This category requires the property owner to have lived in the home for at least two years for every five years owned. If these requirements can be met, the investor can exclude up to $250,000 of any gains made by the sale of the property.

It’s important to note that making the property your primary residence isn’t a cure-all for taxation. A percentage of the gains made on the home will still be taxable, and depreciation recapture taxes will also apply.

Another method of saving on taxes is using a 1031 like-kind exchange. This exchange effectively enables the investor to switch one rental property for another investment home on a tax-deferred basis. This means that any capital gains made on the property will be deferred until it has been sold. For this method to work, the investor must follow certain rules, such as only being used for business assets, having 45 days to identify a property to switch with and having 180 days to close on the new home. Any earnings left over after purchasing the second property will be taxable as capital gains.

Final Thoughts

The taxes due on a rental property at the time of sale can be somewhat complex and calculating the final numbers just plain confusing. Investors that are considering selling their rental home should set up an appointment with a tax professional if they have any qualms with the number-crunching needed to make sure they are maximizing their profits in the right way.

Investors can also make use of tools like a rental property calculator to get a better idea of the profits they can expect to earn on their rental property.

Despite the different types of taxes that are applied to the sale of rental properties, the profits earned from selling a home in a sought after location can more than make up for the amount the investor is liable for. For the average investor with a rental home, ordinary income taxes will apply, capital gains tax will need to be paid and depreciation recapture taxes will also need to be settled.

That being said, the investor also has strategies available to pursue that can reduce the overall amount of tax they are due to pay legally, such as by using the property as a primary residence for a period of time or swapping it with another property in a 1031 like-kind exchange.

At the same time, nothing is more certain than death and taxes, and it’s important for the rental property owner to have a deeper understanding of the financial mechanics of their investment.