Up to 90% Loan-to-Cost with Instant Term Sheet + Proof of Funds

All Hard Money Loans

New Silver Hard Money Loans are designed for property investors who need quick access to capital at competitive interest rates. The entire application process can be completed online, in less than 5 minutes. The following real estate loans are also available:

Fix & Flip

Funds for purchase + rehab or refinance + rehab

Get up to $5,000,000

Interest rate 9.25 - 11.25%

Loan-to-Cost up to 90%

Up to 100% construction

Rent

30 year fixed product for stabilized properties

Get up to $3,000,000

Interest rate from 6.375%

Loan-to-Value up to 80%

30-year fixed rate

Ground Up

Construction loans for residential builders

Get up to $5,000,000

Interest rate 10.5 - 11.5%

Loan-to-Cost up to 90%

Up to 100% construction

Loan Application Process Overview

This short video will walk you through the application process, show you how to get conditionally approved online in under 5 minutes, see your preliminary term sheet and show you how our easy online platform helps you be more successful.

Why New Silver Beats Other Lenders

New Silver

- Extremely fast online application

- Industry leading closing times

- Borrowers get instant proof of funds

- Borrowers get instant term sheets

- Highly flexible loan terms

- Minimizes paperwork

- Expert support from start to finish

- Super fast construction draws, no receipts required

Other Lenders

- Take ages to process applications

- Take too long to close

- Offer manual proof of funds

- Take days to provide a term sheet

- Minimal flexibility with loan terms

- Bury borrowers in paperwork

- Over promise and under deliver

- Slow draws, require proof of payment

Outstanding Customer Reviews

Benefits For Borrowers

Fast

Closing

New Silver offers industry leading loan turnaround times. Our closing speed is second to none.

Instant

Proof of Funds

After completing the application you will be issued with an immediate proof of funds letter.

Excellent

Rates

Our interest only fix-and-flip loans offer competitive interest rates, ranging from 9.25 - 11.25%.

Repeat

Client Discounts

Get steep discounts on origination fees and interest rates for continuing to work with us.

Fast

Feedback

Our customer care team and loan advisors provide quick feedback to all messages.

Interest Rate

Lock

Once the term sheet is signed, the interest rate is locked in for the duration of the loan.

Quick

Application

The 100% online application is short and simple. It can be completed in 5 minutes or less.

Minimal

Paperwork

Our loan application requires minimal paperwork and our lending team is ready to lend a hand when needed.

We Are On Your Side

When you apply for a loan with New Silver, you get access to a world class lending team that can help you meet the challenges of executing profitable real estate deals. If you choose to apply:

Your credit score won't be affected

The application only requires a soft credit pull. Your credit score is completely unaffected by this process.

You don't need any paperwork to apply

You can get pre-qualified for a real estate loan without uploading a single document.

Your loan terms can be customized

The loan terms can be tailored to your individual needs as a borrower. You get fast and flexible financing options.

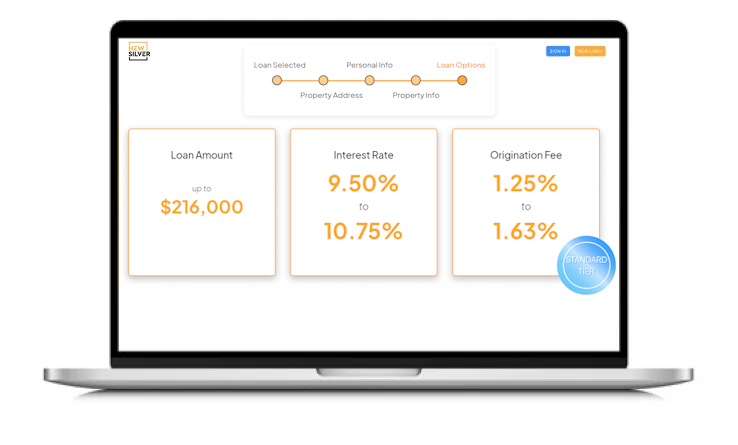

Get A Loan Quote, Instantly

Use this tool to quickly estimate your loan amount, interest rate, repayment and more...

Recently Funded Fix and Flip Projects

$1,449,000

Burbank, CA

$1,125,000

Pasadena, CA

$532,500

Monterey Park, CA

$297,500

Manville, NJ

$661,500

Lawrenceburg, KY

$1,035,000

Southampton, NY

$792,000

Marco Island, FL

$1,618,000

Charlotte, NC

$408,000

Orlando, FL

$277,000

Feeding Hills, MA

Ready to start your fix and flip project?

New Silver can supply the capital you need to buy, renovate and resell properties for maximum profit

Get Approved OnlineFrequently Asked Questions

A hard money loan is a short term real estate loan used by house flippers to purchase and renovate properties. A hard money lender provides the capital the investor needs to purchase the property, complete high ROI renovations, and thereby increase the after repair value of the home.

Crucially, the real estate investor is required to pay back the full loan amount at the end of the loan terms (usually 12-24 months). Usually, the funds from the sale of the house are used to pay back the full loan amount.

In most cases, hard money lenders will provide 70 to 90% of the funds needed to complete the project, meaning that the house flipper is responsible for covering the shortfall.

For hard money loan to work successfully, the after repair value of the property must be substantially more than the original purchase price.

In addition, it’s also worth clarifying that there several different types of hard money loans, including:

Reputable Hard Money Lenders like New Silver offer interest-only repayment terms. For example, if you were offered a $200,000 hard money loan, with a 10% interest rate, your monthly payment would work out to $1666.66. Here’s how it works:

- Amount Borrowed: $200,000

- Annual Interest Rate: 10%

- Monthly Repayment: Amount Borrowed * Annual Interest Rate / 12

- Monthly Repayment: $200,000 * 10% / 12

- Monthly Payments: $1666.66

In other words, your monthly payment only covers the interest portion of the capital that was borrowed. However, you are required to pay back all the capital that was borrowed when the hard money loan expires.

It helps to think of it as a balloon payment, but instead of paying a portion of the capital back, your balloon payment covers 100% of the amount borrowed.

Hard Money Loan Monthly Payments only cover the interest portion of the loan. This means that with each monthly payment, you don’t make a dent in the total capital that was borrowed. Instead, the expectation is that you will pay back 100% of the capital, when the hard money loan terms come to an end.

For example, let’s imagine you applied for hard money financing to the value of $150,000, with an interest rate of 10% and a loan term of 6 months. In this case you would pay:

- Month 1: $1250 ($150,000 * 10% / 12)

- Month 2: $1250

- Month 3: $1250

- Month 4: $1250

- Month 5: $1250

- Month 6: $1250

- End of the loan: $150,000

As you can see from the hard money loan example above, you only pay off the interest portion of the loan each month. You repay the full capital amount when the loan expires, using the funds from the sale of the house that was flipped to do so.

Apart from a higher interest rate, this is one of the main ways in which hard money loans differ from traditional loans. With a traditional loans, the monthly payment is a mixture of the interest owed and the outstanding capital amount. This is what allows the borrower to pay off their entire mortgage over time. The borrower basically chips away at the capital month after month and year after year. When the loan comes to an end, there is no more capital to pay off.

This traditional financing approach doesn’t work for house flippers, because of the cash flow challenges that it would introduce. Conversely hard money lending provides a short term loan solution for property investors that need to successfully execute a real estate deal.

Hard Money Loan Rates typically range from 7.5% to 15%, depending on the hard money loan lender that you choose, the borrower‘s creditworthiness, and the amount of house flipping experience that the investor has.

In most cases, these three attributes will have a massive impact on the final rate that is offered to you. Generally speaking, the better your credit history and the more house flipping experience you have, the lower the hard money loan rate will be.

In most cases, the house flipper is required to put down between 10% and 20% of the project cost in order to initiate a hard money loan. For example, if the hard money lender covers 85% of the project cost, the investor would need to cover the shortfall of 15%.

On average, real estate investors need a 650 credit score. Compare that to the average 680 – 750 credit score traditional lenders require and it’s easy to see why hard money loans are a great option.

If you plan to keep the home and rent it out, you may find credit score requirements to be a little higher – usually around 660 only because the risk is higher.

On a broad level, hard money loans and bridge loans are very similar. However, bridge loans can be offered by traditional finance institutions, and they can be used to fund a wider range of purchases (rather than just real estate).

On the other hand, hard money loans are designed specifically for real estate investors. Short term hard money loans are designed for house flipping projects and and ground up construction projects. Long term (30 year) hard money loans are designed for rental property investors.

While the interest rates on traditional loans are typically lower than hard money loans, the approval process is far more stringent and time-consuming. This can be a dealbreaker when you spot an opportunity for a fix and flip. In most cases, you need to move swiftly in order to capture the deal. That is why a hard money lender like New Silver can be so useful to investors. Effectively you get:

- Flexible loan terms

- Easy loan applications

- Less stringent financial requirements

- Speedy approval and closing

- Instant proof of funds

The origination fee is an additional cost associated with hard money loans. It usually ranges from 1-3% of the loan, but this is ultimately up to the lender that you choose. It is the expense that the lender charges the borrower to cover all the costs associated with initializing the loan.

So, if your loan amount is $200,000 and the origination fee is 1%, that would result in a cost of $2,000. This cost is built-in as a percentage in our hard money calculator. You can change it, using the dial in the calculator.