Up to 90% Loan-to-Cost with Instant Term Sheet + Proof of Funds

All Property Development Loans

New Silver Home Construction Loans are designed for property developers who need quick access to capital at competitive interest rates. The entire application process can be completed online, in less than 5 minutes. The following real estate loans are also available.

Ground Up

Construction loans for residential builders

Get up to $5,000,000

Interest rate 10.5 - 11.5%

Loan-to-Cost up to 90%

Up to 100% construction

Fix & Flip

Funds for purchase + rehab or refinance + rehab

Get up to $5,000,000

Interest rate 9.25 - 11.25%

Loan-to-Cost up to 90%

Up to 100% construction

Rent

30 year fixed product for stabilized properties

Get up to $3,000,000

Interest rate from 6.375%

Loan-to-Value up to 80%

30-year fixed rate

Loan Application Process Overview

This short video will walk you through the application process, show you how to get conditionally approved online in under 5 minutes, see your preliminary term sheet and show you how our easy online platform helps you be more successful.

Why New Silver Beats Other Lenders

New Silver

- Extremely fast online application

- Industry leading closing times

- Borrowers get instant proof of funds

- Borrowers get instant term sheets

- Highly flexible loan terms

- Minimizes paperwork

- Expert support from start to finish

- Super fast construction draws, no receipts required

Other Lenders

- Take ages to process applications

- Take too long to close

- Offer manual proof of funds

- Take days to provide a term sheet

- Minimal flexibility with loan terms

- Bury borrowers in paperwork

- Over promise and under deliver

- Slow draws, require proof of payment

Outstanding Customer Reviews

Benefits For Property Developers

Fast

Closing

New Silver offers industry leading loan turnaround times. Our closing speed is second to none.

Instant

Proof of Funds

After completing the application you will be issued with an immediate proof of funds letter.

Excellent

Rates

Our interest only construction loans offer competitive interest rates, ranging from 10.5 - 11.5%.

Repeat

Client Discounts

Get steep discounts on origination fees and interest rates for continuing to work with us.

Fast

Feedback

Our customer care team and loan advisors provide quick feedback to all messages.

Interest Rate

Lock

Once the term sheet is signed, the interest rate is locked in for the duration of the loan.

Quick

Application

The 100% online application is short and simple. It can be completed in 5 minutes or less.

Minimal

Paperwork

Our loan application requires minimal paperwork and our lending team is ready to lend a hand when needed.

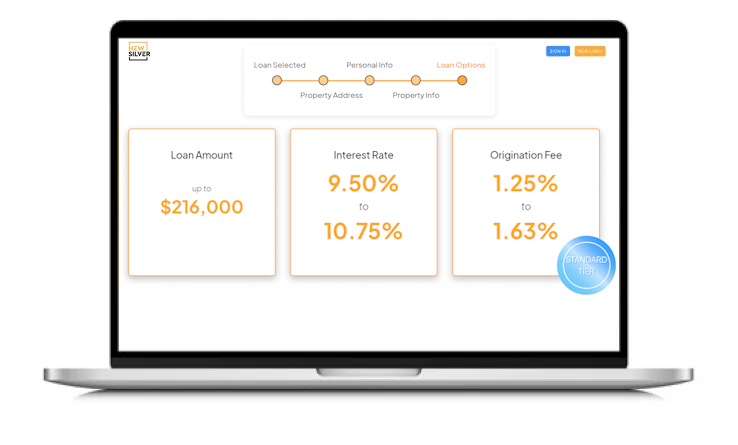

Get A Loan Quote, Instantly

Use this tool to quickly estimate your loan amount, interest rate, repayment and more...

We Are On Your Side

When you apply for a loan with New Silver, you get access to a world class lending team that can help you meet the challenges of executing profitable real estate deals. If you choose to apply:

Your credit score won't be affected

The application only requires a soft credit pull. Your credit score is completely unaffected by this process.

You don't need any paperwork to apply

You can get pre-qualified for a real estate loan without uploading a single document.

Your loan terms can be customized

The loan terms can be tailored to your individual needs as a borrower. You get fast and flexible financing options.

Frequently Asked Questions

Here’s a step-by-step guide which explains how construction loans work.

Project Preparation: Define your construction project, assess your financial situation, and determine the loan size needed.

Choose a Lender: Compare rates and terms, in order to choose an experienced construction lender.

Gather Documents: Collect the required documents, including project plans, financial proof, credit report, and down payment estimate. Complete the loan application.

Loan Terms: After reviewing your application, the lender provides loan terms, including rates, repayment period, loan amount, and fees. Review and understand these terms.

Loan Closing: Sign the loan agreement, pay closing costs (e.g., origination fees, appraisal fees), provide the down payment, and receive the funds.

Construction loan rates generally range between 10.5 – 11.5%, depending on the lender. These interest rates are based on market conditions, the borrower’s financial position, location, lender terms and the Loan-To-Value (LTV) ratio.

Origination fees on construction loans range between 1% and 3% of the loan amount. These fees are charged by the lender to facilitate and process the loan.

Additional closing costs associated with construction loans are appraisal fees, title insurance, legal and escrow fees, credit report fees and insurance costs.

There are a number of Construction Loan Requirements.

Interest Rates and Fees: These loans often have higher interest rates and fees due to the increased risk. New Silver’s rates typically range between 10 and 13.25%.

Origination Fee: There’s an upfront fee, starting at 1.875%, to cover processing and underwriting costs. It’s paid at loan closing.

Minimum Down Payment: Lenders require a down payment, usually 10-20% for New Silver, demonstrating commitment to the project.

Minimum FICO Score: While real estate deal quality matters most, a minimum FICO score of 650 is required.

Loan To Cost (LTC): New Silver offers an LTC of up to 90%, covering that percentage of the total project cost.

Loan To ARV: New Silver provides a Loan To ARV ratio of up to 80%, covering a percentage of the property’s after-repair value.

Construction Financing: New Silver covers up to 100% of construction financing. A detailed plan and contractor information may be necessary.

Loan Term: New Silver offers loan terms of up to 24 on construction loans, outlining interest rate, duration, fees, and more.

Minimum and Maximum Loan Amounts: New Silver’s minimum loan amount is $100,000, and the maximum is $5,000,000.

Property Type: New Silver’s construction loans cover various property types, including Residential 1-4 units, condos, townhomes.

Property Appraisal: A professional appraisal is required to assess the property’s current and expected value after renovations.

These requirements guide borrowers through the process of securing a construction loan from New Silver.

There are various types of construction loans that can be used by real estate investors for different purposes. Flexibility and tailored financial solutions are vital parts of creating a successful construction project. Three of the most useful types of construction loans are construction to permanent loans, construction-only loans and renovation loans.

The 3 Main Types Of Construction Loans

There are various types of construction loans that can be used by real estate investors for different purposes. Flexibility and tailored financial solutions are vital parts of creating a successful construction project. Three of the most useful types of construction loans are construction to permanent loans, construction-only loans and renovation loans.

1. Construction to Permanent Loan

A construction to permanent loan (C2P loan) is essentially a two-in-one financing option. The construction phase of the project is covered by the construction to permanent loan, which then transitions into a traditional mortgage.

During the construction phase of the project, borrowers can use the construction loan to fund the building of the property, and they only need to pay the interest on the loan. During the construction phase, borrowers will receive funds in stages or draws to pay for building costs. These draws are typically based on completed milestones, to provide the necessary funds at each stage of construction.

Once this phase is complete, construction to permanent loans will then transition into traditional mortgage or permanent loans which will have longer terms of 15 to 30 years. From there, borrowers will need to make payments that cover both the interest and the principal loan amount.

2. Construction-Only Loan

As the name suggests, a construction-only loan is used solely for the purpose of financing the construction phase of a real estate project. These loans typically have shorter terms that range from 6 months to a couple of years, along with adjustable rates. Construction-only loans are best suited to real estate investors who are going to sell the property once the construction is complete.

During the construction phase borrowers only need to pay the interest on the loan, which is an advantage as it creates more freedom in the borrower’s cash flow. Once the construction phase is complete, the loan will need to be paid back in entirety, or refinanced into a mortgage.

Investors who plan on selling the property once the renovations are complete would usually use this type of construction loan. It allows for flexibility with investors who have a shorter-term outlook on the project and gives investors what they need during the construction phase.

3. Renovation Loans

Renovation loans typically cover the cost of purchasing a home and renovating it. The loan amount is therefore based on the anticipated value of a property after the renovations have been done. Renovation loans offer flexibility in financing both minor and major renovations, such as structural repairs, room additions, or cosmetic upgrades.

This loan type is suited to those who are upgrading an existing home, rather than building a new one. The options which fall under renovation loans include a cash-out refinance and Home Equity Line of Credit (HELOC). Typically, a lender will not require the borrower to disclose exactly how the funds are going to be used in this scenario, so the homeowner or investors would manage the budget, plans and payments themselves.

The main benefit of renovation loans is that they offer a large amount of flexibility and autonomy to borrowers, who can use the funds as they need.