When you’re comparing hard money loans, you’ll quickly find that the rates will differ from lender to lender. There are several reasons for this; different locations, lenders with varying requirements and even the specific project can affect the level of rates you need to plan for.

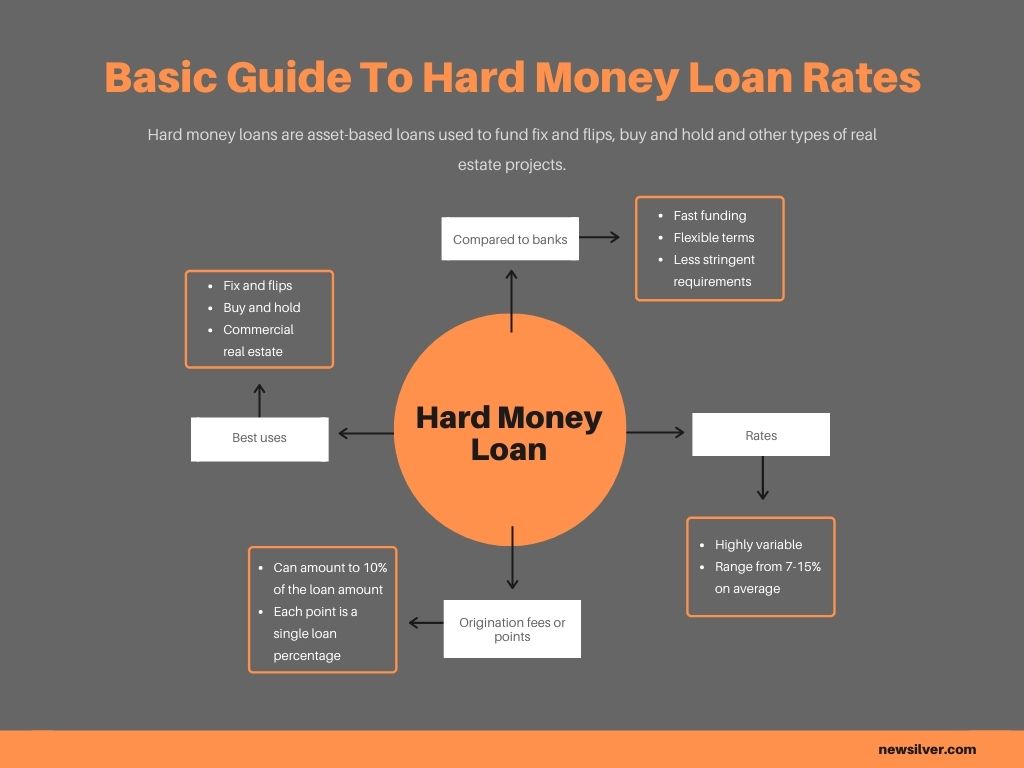

First, a quick overview of hard money loans. Also known as asset-based loans, this type of funding is sourced from private investors or non-bank financiers and usually granted over shorter terms. You can expect most lenders to want to see the majority of the loan amount and interest paid back between one and five years after being granted.

Getting back to rates, it’s important to understand how these rates apply, how to compare them and find the right lender for your next project. Keep reading for our full guide to hard money loan rates.

Table of Contents

Hard Money Rates Versus Bank Rates

It’s difficult to directly compare the rates available from banks versus hard money lenders because they typically serve different purposes. Home loans from banks are typically granted for primary residences with a fixed mortgage over a longer period of time, while hard money loans are funding investors that want to sell the home as soon as possible.

For bank loans, the average rates for a 30 year fixed rate mortgage are just under 4%, although the rates on offer can vary between 3% and over 7%. Since these rates are spread out over such a long term, the cost to the borrower is lower.

The problem is, that this comes with some caveats. As mentioned above, banks are unlikely to fund an investor that wants to flip or quickly resell. Another problem is how long it can take to secure funding. Banks will have extensive application and review processes that need to be completed before they grant the borrower access to the funds. In the fast-moving world of flips, this can cost the investor a valuable deal.

Enter hard money loans. These are loans that are granted by private investors, usually those who are planning to fix and flip or to buy and hold a property to rent out. These lenders do not have to ascribe to the same strict regulations as banks, which allows them to lend to investors of all backgrounds at a much faster rate than banks can offer.

Since many of these lenders are powered by private investors, it’s difficult to find an exact average when it comes to rates. Lenders in different states will provide you with very different offerings, and you’ll need to vet them carefully before solidifying your loan. With a hard money loan you can expect rates to be somewhere between 9% and 15% depending on the lender location, requirements and the type of property you are applying with. At New Silver, interest rates start at 10%.

The other thing you need to keep in mind when applying for hard money loans is that the lender can also charge hard money points on the loan in addition to the rates given. Sometimes also referred to as origination fees, these are added to cover the administrative cost of granting the loan and to help the lender minimize risk.

Origination Fees And Other Hard Money Loan Costs

When it comes to origination fees, it’s easiest to consider each point as a percentage of the loan. Most hard money lenders ask up to 10% of the loan amount in points. These points need to be settled along with each hard money loan you apply for. When paying interest, on the other hand, you’ll pay it along with your monthly loan repayment.

Let’s talk about hard money loan amounts and how the lender will calculate how much they can offer you. Known as the loan to value (LTV) ratio, lenders will take the requested loan amount and divide it by the value of the home being applied with. The LTV ratio helps the lender decide if the property is worth funding or not. Most lenders will provide the borrower with a loan amount equal to 60 or 70% of the home’s value. That means that as the borrower, you’ll need to put down some down payment, as much as 30%. The LTV ratio ultimately ensures that both parties have a stake in the project.

After the LTV, there are a few other costs to talk about. The appraisal fee will need to be paid by the borrower in order to get a licensed appraiser to come and assess the property. There may also be referral fees that apply – this can apply if a realtor has referred you to the lender, whereupon a referral fee will be due to them and settled by the borrower as part of their loan costs.

Lastly, you need to check the fine print for prepayment penalties. Some lenders can add charges if you pay off your loan earlier than the stipulated term. Try to avoid this cost if you can.

Criteria That Impact Hard Money Loan Rates

As mentioned above, the average hard money loan rates can be affected by a number of factors all with their own merit. Beyond the location of the property, the size and condition of the home can play a big role in setting the interest rate but they’re not the only things to worry about.

There are a few additional things to keep in mind if you want to get good rates on hard money loans:

Follow the money

The best real estate lenders may not be in your exact area. You can choose to work with a national lender, but you may want to consider buying in a location that has several lenders available – this way you can be sure you’ll get the best rates. Do your homework about lenders in the area before you decide to buy.

The location of the home

The location of the home can play a big role in the rates that will accompany the loan. In real estate, there are what are known as “mortgage states” and “deed of trust” states. In mortgage states, hard money lenders need to go through a judicial foreclosure process which can be time-intensive and expensive. In “deed of trust” states, lenders can foreclose during a trustee sale leading to lower interest rates.

Know your goals

If you plan to flip a property for a profit, you need to find a lender that will align with these goals. The amount you apply to borrow needs to be close to the current value or the future value when the home has been completely renovated. Estimating as accurately as possible is key if you want to get ahead of costs like interest rates and other renovation costs.

Underwriting policies

Each lender will have their own unique underwriting requirements, so it’s important to do your homework and find out what you’ll need to submit if you want to proceed. Hard money lenders are more flexible than banks when it comes to their borrower’s financial histories, which means if you have a less-than-stellar credit score there is still hope.

As each loan is handled on a case-by-case basis, the exact terms of your loan will depend on the property deal you are trying to secure. Pay careful attention to the LTV of the home you are considering – the higher the LTV ratio, the higher the risk for the lender which then leads to higher interest rates.

Let’s say you are trying to obtain a property loan for $100,000. For this type of loan, the lender is charging 3 points, or $3,000. These points will have to be paid by you upfront, and if you can pay off your loan on time you can achieve a good ROI. The loan will also accumulate interest over time, which is why selling as fast as possible is key. If you can pay off the loan early, you can skip out on the high interest rate caused by accumulation.

When Hard Money Loans Are Best Used

Hard money loans are not suitable for every kind of real estate. This type of loan is best suited to investors that are looking to buy a home for the purpose of renting it out, or to renovate it and resell it as soon as possible. Another potential purpose has to do with commercial real estate such as apartment buildings, retail spaces or others that also take tenants.

For house flippers in particular, this type of funding is ideal. Because these investors want to acquire and fix up the home as fast as possible, they need to be able to find funding quickly, ideally with the option to provide instant proof of funds and fast closing. These are a few of the benefits commonly associated with hard money loans, as are flexibility in loan terms and the possibility of negotiating.

Some of the disadvantages, on the other hand, are that these loans can be higher in interest rates, the loan fees can be higher than those found in traditional loans and you’ll have to put down a significant down payment. Remember, the more valuable the property is that you are applying for, the better the loan amount the lender will be able to offer you.

How To Qualify For A Hard Money Loan

While you don’t have to be a professional house flipper to qualify, you can expect the lender to ask you about your previous real estate experience. The lender will likely also need to do their own appraisal or inspection of the property, in which they’ll assess the value and how much they would be willing to provide as a loan.

Other things they may require will be proof that you have enough funds to make a down payment, and while your credit rating won’t be a make or break factor the chances are good that they’ll want to discuss it.

Hard Money Loan Rates: The Final Word

The rates you get on your hard money loan will depend on a variety of factors, but using this guide you can start to estimate what it will cost you. You’ll want to ensure that you pre-vet the lenders you are considering very carefully, paying attention to their previous reviews, the terms and fees they offer and what your exit strategy will be.